Capital One 2003 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2003 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Senior Notes

Bank Notes

Senior and Subordinated Global Bank Note Program

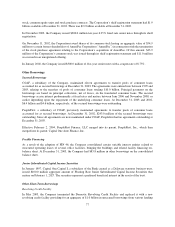

The Senior and Subordinated Global Bank Note Program gives the Bank the ability to issue securities to both

U.S. and non-U.S. lenders and to raise funds in U.S. and foreign currencies. The Senior and Subordinated Global

Bank Note Program had $4.7 billion and $2.7 billion outstanding at December 31, 2003 and 2002, respectively.

In January 2003, the Bank increased its capacity under the Senior and Subordinated Global Bank Note Program

to $8.0 billion and in May 2003 updated this Program. Prior to the establishment of the Senior and Subordinated

Global Bank Note Program, the Bank issued senior unsecured debt through its $8.0 billion Senior Domestic Bank

Note Program, of which $526.5 million and $1.3 billion was outstanding at December 31, 2003 and 2002,

respectively. The Bank did not renew the Senior Domestic Bank Note Program for future issuances following the

establishment of the Senior and Subordinated Global Bank Note Program.

During 2003, the Company issued $600 million of five-year 4.875% fixed rate senior bank notes, $500 million of

ten-year 6.5% fixed rate subordinate bank notes, $600 million of seven-year 5.75% fixed rate senior bank notes,

and $500 million of five-year 4.25% fixed rate senior bank notes under the Senior and Subordinated Global Bank

Note Program.

In July 2002, the Company repurchased senior bank notes in the amount of $230.4 million, which resulted in a

pre-tax gain of $27.0 million.

In February 2004, the Company issued $500 million of ten-year 5.125% fixed rate senior bank notes under the

Senior and Subordinated Global Bank Note Program.

Mandatory Convertible Securities

In April 2002, the Company completed a public offering of mandatory convertible debt securities (the “Upper

Decs®”), that resulted in net proceeds of approximately $725.1 million. The net proceeds were used for general

corporate purposes. Each Upper Dec®initially consists of and represents (i) a senior note due May 17, 2007 with

a principal amount of $50, on which the Company will pay interest quarterly at the initial annual rate of 6.25%,

and (ii) a forward purchase contract pursuant to which the holder has agreed to purchase, for $50, shares of the

Company’s common stock on May 17, 2005 (or earlier under certain conditions), with such number of shares to

be determined based upon the average closing price per share of the Company’s common stock for 20

consecutive trading days ending on the third trading day immediately preceding the stock purchase date at a

minimum per share price of $63.91 and a maximum per share price of $78.61. The minimum and maximum

amount of shares to be issued by the Company is 9.5 million and 11.7 million shares, respectively.

The senior notes will initially be pledged to secure the holder’s obligations under the forward purchase contracts.

Each holder of an Upper Dec®may elect to withdraw the pledged senior notes or treasury securities underlying

the Upper Decs®by substituting, as pledged securities, specifically identified treasury securities that will pay $50

on the relevant stock purchase date, which is the amount due on that date under each forward purchase contract.

In February 2005, the senior notes will be remarketed, and the interest rate will be reset based on interest rates in

effect at the time of remarketing. The holders will use the proceeds of the remarketing to fund their obligations to

purchase shares of the Company’s common stock under the forward purchase contract, with such number of

shares to be determined based upon the average closing price per share of the Company’s common stock for 20

consecutive trading days ending on the third trading day immediately preceding the stock purchase date at a

minimum per share price of $63.91 and a maximum per share price of $78.61.

Corporation Shelf Registration Statement

As of December 31, 2003, the Corporation had one effective shelf registration statements under which the

Corporation from time to time may offer and sell senior or subordinated debt securities, preferred stock, common

76