Capital One 2003 Annual Report Download - page 89

Download and view the complete annual report

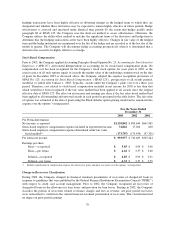

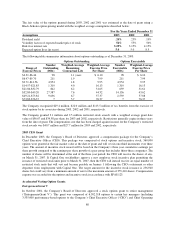

Please find page 89 of the 2003 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The 2002 change in the classification of recoveries resulted in a change to the 2002 recoveries estimate used as

part of the calculation of the Company’s December 31, 2002 allowance for loan losses and 2002 finance charge

and fee revenue. The change in the recoveries estimate resulted in an increase to the allowance for loan losses

and a reduction of the amount of finance charges and fees deemed uncollectible under the Company’s revenue

recognition policy for the year ended December 31, 2002. The change in estimate resulted in an increase of $38.4

million to interest income and $44.4 million to non-interest income offset by an increase in the provision for loan

losses of $133.4 million for the year ended December 31, 2002. Therefore, net income for the year ended

December 31, 2002, was negatively impacted by $31.4 million or $.14 per diluted share as a result of the change

in estimate.

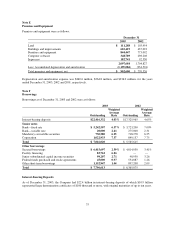

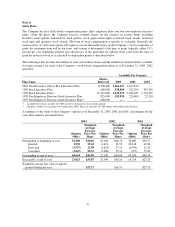

Note B

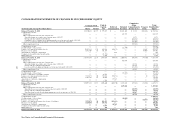

Segments

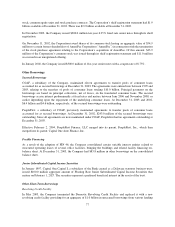

Based on an internal assessment of the information the Company uses to make resource allocation decisions and

measure performance, reportable segments, as defined by SFAS 131, were revised during the fourth quarter of

2003. Prior years’ amounts have been reclassified to conform to the new presentation.

The Company maintains three distinct operating segments: U.S. Card, Auto Finance, and Global Financial

Services. The U.S. Card segment consists of domestic credit card lending activities. The Auto Finance segment

consists of automobile financing activities. The Global Financial Services segment is comprised of international

lending activities, installment lending, small business lending, patient financing, and other investment businesses.

The U.S. Card, Auto Finance and Global Financial Services segments are considered reportable segments based

on quantitative thresholds applied to the managed loan portfolio for reportable segments provided by SFAS No.

131 and are disclosed separately. The Other caption includes the Company’s liquidity portfolio, emerging

businesses not included in the reportable segments, investments in external companies, and various non-lending

activities. The Other caption also includes the net impact of transfer pricing, certain unallocated expenses and

gains/losses related to the securitization of assets.

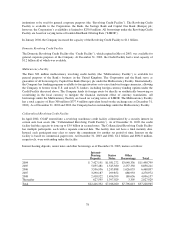

Management decision making is performed on a managed portfolio basis. An adjustment to reconcile the

managed financial information to the reported financial information in the consolidated financial statements is

provided. This adjustment reclassifies a portion of net interest income, non-interest income and provision for

loan losses into non-interest income from servicing and securitization.

71