Capital One 2003 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2003 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

with other company charge-off forecasts. The principal repayment rate assumptions are determined using actual

and forecasted trust principal repayment rates based on the collateral. The lives of receivables are determined as

the number of months necessary to pay off the investors given the principal repayment rate assumptions. The

discount rates are determined using primarily trust specific statistics and forward rate curves, and are reflective of

what market participants would use in a similar valuation.

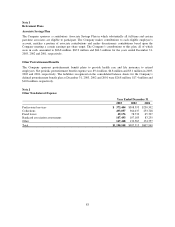

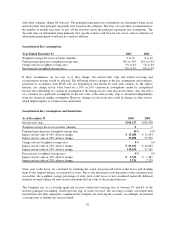

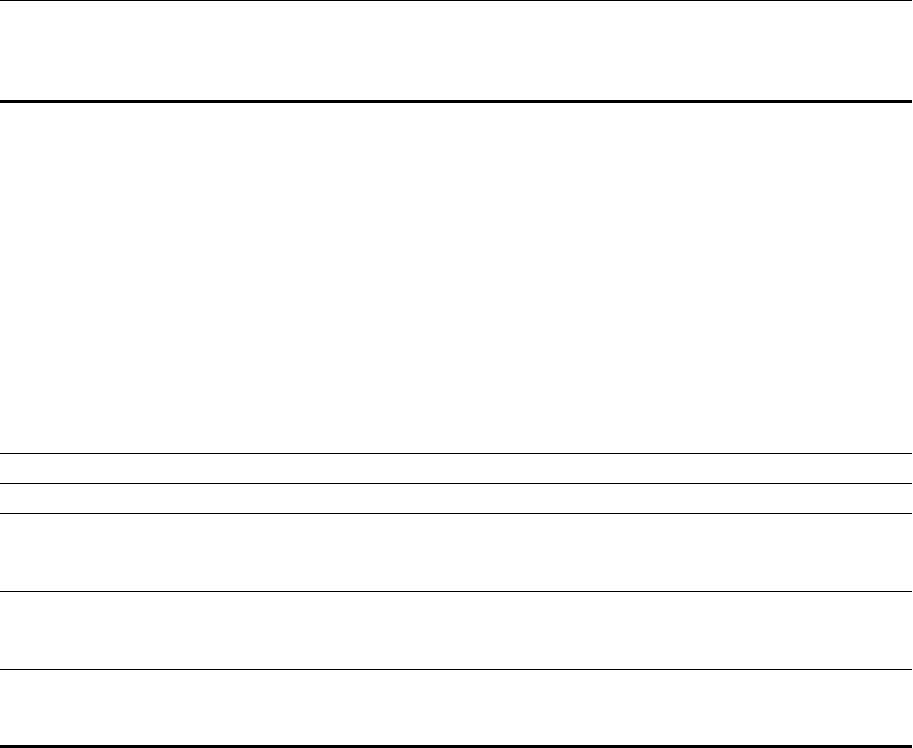

Securitization Key Assumptions

Year Ended December 31 2003 2002

Weighted average life for receivables (months) 9 to 10 8 to 10

Principal repayment rate (weighted average rate) 14% to 15% 13% to 15%

Charge-off rate (weighted average rate) 5% to 6% 5% to 6%

Discount rate (weighted average rate) 8% to 9% 8% to 9%

If these assumptions are not met, or if they change, the interest-only strip and related servicing and

securitizations income would be affected. The following adverse changes to the key assumptions and estimates,

presented in accordance with SFAS 140, are hypothetical and should be used with caution. As the figures

indicate, any change in fair value based on a 10% or 20% variation in assumptions cannot be extrapolated

because the relationship of a change in assumption to the change in fair value may not be linear. Also, the effect

of a variation in a particular assumption on the fair value of the interest-only strip is calculated independently

from any change in another assumption. However, changes in one factor may result in changes in other factors,

which might magnify or counteract the sensitivities.

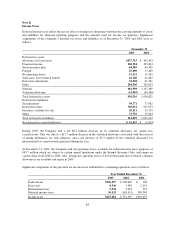

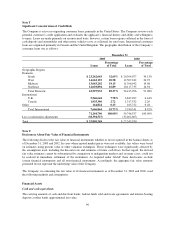

Securitization Key Assumptions and Sensitivities

As of December 31 2003 2002

Interest-only strip $304,227 $236,398

Weighted average life for receivables (months) 99

Principal repayment rate (weighted average rate) 14% 14%

Impact on fair value of 10% adverse change $ 15,480 $ 15,353

Impact on fair value of 20% adverse change 27,898 27,252

Charge-off rate (weighted average rate) 5% 6%

Impact on fair value of 10% adverse change $ 60,261 $ 46,083

Impact on fair value of 20% adverse change 119,014 92,167

Discount rate (weighted average rate) 9% 8%

Impact on fair value of 10% adverse change $ 1,326 $ 1,387

Impact on fair value of 20% adverse change 3,226 2,733

Static pool credit losses are calculated by summing the actual and projected future credit losses and dividing

them by the original balance of each pool of assets. Due to the short-term revolving nature of the consumer loan

receivables, the weighted average percentage of static pool credit losses is not considered materially different

from the assumed charge-off rates used to determine the fair value of the retained interests.

The Company acts as a servicing agent and receives contractual servicing fees of between 2% and 6% of the

investor principal outstanding, based upon the type of assets serviced. The servicing revenues associated with

transferred receivables adequately compensate the Company for servicing the accounts. Accordingly, no material

servicing asset or liability has been recorded.

92