Capital One 2003 Annual Report Download - page 72

Download and view the complete annual report

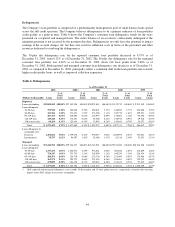

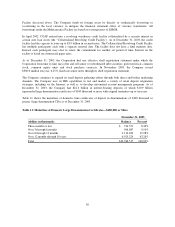

Please find page 72 of the 2003 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Additional information regarding derivative instruments can be found on page 93 in Item 8 “Financial Statements

and Supplementary Data—Notes to the Consolidated Financial Statements—Note S”.

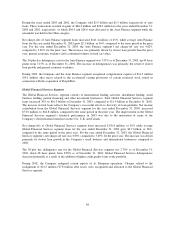

Market Risk Management

Interest Rate Risk

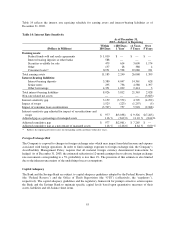

Interest rate risk refers to changes in earnings or the net present value of assets and off-balance sheet positions

less liabilities (termed “economic value of equity”) due to interest rate changes. To the extent that managed

interest income and expense do not respond equally to changes in interest rates, or that all rates do not change

uniformly, earnings and economic value of equity could be affected. The Company’s managed net interest

income is affected primarily by changes in short-term interest rates, as variable rate card receivables,

securitization bonds and corporate debts are repriced. The Company manages and mitigates its interest rate

sensitivity through several techniques, which include, but are not limited to, changing the maturity and repricing

characteristics of various balance sheet categories and by entering into interest rate swaps.

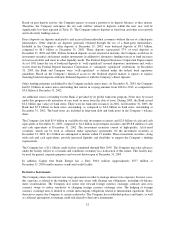

The Company’s measurement of interest rate risk considers both earnings and market value exposures. An

earnings simulation model generates a distribution of 12-month managed net interest income outcomes based on

a plausible set of interest rate paths, which are generated from an industry-accepted term structure model. The

interest rate scenarios evaluated as of December 31, 2003 included scenarios in which short-term interest rates

rose by over 470 basis points or fell by as much as 110 basis points over the 12 months. The consolidated balance

sheet and all off-balance sheet positions are included in the analysis. When available, contractual maturities

related to balance sheet and off-balance sheet positions are assumed. Balance sheet positions lacking contractual

maturities and those with a likelihood of maturing prior to their contractual term are assumed to mature

consistent with business line expectations or, when available in the case of marketable securities, market

expectations. The Company’s Asset/Liability Management Policy requires that based on the forecasted

distribution of interest rate paths there be no more than a 5% probability of a reduction in 12-month net interest

income of more than 3% of base net interest income. As of December 31, 2003, the estimated reduction in 12-

month net interest income corresponding to a 5% probability is less than 1%.

The Asset/Liability Management Policy also limits the change in 12-month net interest income due to

instantaneous parallel rate shocks of up to 300 basis points to less than 3% of base net interest income. An

adverse instantaneous rate shock of up to 300 basis points is estimated to reduce 12-month net interest income by

less than 1% as of December 31, 2003.

In addition to limits related to possible changes in 12-month net interest income, the Asset/Liability Management

Policy limits the change in economic value of equity due to instantaneous parallel rate shocks of 100 basis points

to less than 6%. As of December 31, 2003, the estimated reduction in economic value of equity due to an adverse

100 basis point rate shock is less than 3%.

As of December 31, 2003, the Company was in compliance with all of its interest rate risk management related

policies. The precision of the measures used to manage interest rate risk is limited due to the inherent uncertainty

of the underlying forecast assumptions. The measurement of interest rate sensitivity also does not consider the

effects of changes in the overall level of economic activity associated with various interest rate scenarios or

reflect the ability of management to take action to further mitigate exposure to changes in interest rates. This

action may include, within legal and competitive constraints, the repricing of interest rates on outstanding credit

card loans.

54