Capital One 2003 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2003 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

institutions to be used for general corporate purposes (the “Revolving Credit Facility”). The Revolving Credit

Facility is available to the Corporation, the Bank, the Savings Bank and Capital One Bank (Europe) plc;

however, the Corporation’s availability is limited to $250.0 million. All borrowings under the Revolving Credit

Facility are based on varying terms of London InterBank Offering Rate (“LIBOR”).

In January 2004, the Company increased the capacity of the Revolving Credit Facility to $1.1 billion.

Domestic Revolving Credit Facility

The Domestic Revolving Credit Facility (the “Credit Facility”), which expired in May of 2003, was available for

general corporate purposes of the Company. At December 31, 2002, the Credit Facility had a total capacity of

$1.2 billion all of which was available.

Multicurrency Facility

The Euro 300 million multicurrency revolving credit facility (the “Multicurrency Facility”) is available for

general purposes of the Bank’s business in the United Kingdom. The Corporation and the Bank serve as

guarantors of all borrowings by Capital One Bank (Europe), plc under the Multicurrency Facility. Internationally,

the Company has funding programs available to foreign investors or to raise funds in foreign currencies, allowing

the Company to borrow from U.S. and non-U.S. lenders, including foreign currency funding options under the

Credit Facility discussed above. The Company funds its foreign assets by directly or synthetically borrowing or

securitizing in the local currency to mitigate the financial statement effect of currency translations. All

borrowings under the Multicurrency Facility are based on varying terms of LIBOR. The Multicurrency Facility

has a total capacity of Euro 300 million ($377.4 million equivalent based on the exchange rate at December 31,

2003). As of December 31, 2003 and 2002, the Company had no outstandings under the Multicurrency Facility.

Collateralized Revolving Credit Facility

In April 2002, COAF entered into a revolving warehouse credit facility collateralized by a security interest in

certain auto loan assets (the “Collateralized Revolving Credit Facility”). As of December 31, 2003, the credit

facility had the capacity to issue up to $3.9 billion in secured notes. The Collateralized Revolving Credit Facility

has multiple participants, each with a separate renewal date. The facility does not have a final maturity date.

Instead, each participant may elect to renew the commitment for another set period of time. Interest on the

facility is based on commercial paper rates. At December 31, 2003 and 2002, $1.2 billion and $894.0 million,

respectively, were outstanding under the facility.

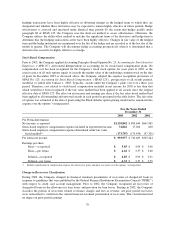

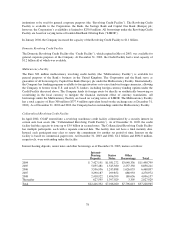

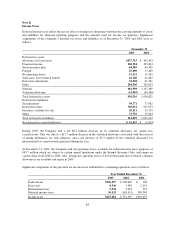

Interest-bearing deposits, senior notes and other borrowings as of December 31, 2003, mature as follows:

Interest-

Bearing

Deposits

Senior

Notes

Other

Borrowings Total

2004 $ 7,427,191 $1,031,272 $3,040,336 $11,498,799

2005 5,055,481 1,545,380 2,257,350 8,858,211

2006 3,596,956 1,245,888 1,626,053 6,468,897

2007 3,290,187 299,852 688,933 4,278,972

2008 2,418,922 1,496,599 180,636 4,096,157

Thereafter 627,595 1,397,029 3,305 2,027,929

Total $22,416,332 $7,016,020 $7,796,613 $37,228,965

78