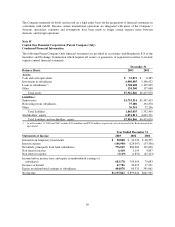

Capital One 2003 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2003 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.which occurred in the first quarter of 2003, and is based on LIBOR rates applied to the cost of the building

funded. If, at the end of the lease term, the Company does not purchase the property, the Company guarantees a

maximum residual value of up to $114.8 million representing approximately 72% of the $159.5 million cost of

the building. This agreement, made with a multi-purpose entity that is a wholly-owned subsidiary of one of the

Company’s lenders, provides that in the event of a sale of the property, the Company’s obligation would be equal

to the sum of all amounts owed by the Company under a note issuance made in connection with the lease

inception. As of December 31, 2003, the value of the building was estimated to be above the maximum residual

value that the Company guarantees; thus, no deficiency existed and no liability was recorded relative to this

property.

Other Guarantees

In connection with an installment loan securitization transaction, the transferee (off-balance sheet special purpose

entity receiving the installment loans) entered into an interest rate hedge agreement (the “swap”) with a

counterparty to reduce interest rate risk associated with the transaction. In connection with the swap, the

Corporation entered into a letter agreement guaranteeing the performance of the transferee under the swap. If at

anytime the Class A invested amount equals zero and the notional amount of the swap is greater than zero

resulting in an “Early Termination Date” (as defined in the securitization transaction’s Master Agreement), then

(a) to the extent that, in connection with the occurrence of such Early Termination Date, the transferee is

obligated to make any payments to the counterparty pursuant to the Master Agreement, the Corporation shall

reimburse the transferee for the full amount of such payment and (b) to the extent that, in connection with the

occurrence of an Early Termination Date, the transferee is entitled to receive any payment from the counterparty

pursuant to the Master Agreement, the transferee will pay to the Corporation the amount of such payment. At

December 31, 2003, the maximum exposure to the Corporation under the letter agreement was approximately

$10.4 million.

Securities Litigation

Beginning in July 2002, the Corporation was named as a defendant in twelve putative class action securities

cases. All twelve actions were filed in the United States District Court for the Eastern District of Virginia. Each

complaint also named as “Individual Defendants” several of the Corporation’s executive officers.

On October 1, 2002, the Court consolidated these twelve cases. Pursuant to the Court’s order, Plaintiffs filed an

amended complaint on October 17, 2002, which alleged that the Corporation and the Individual Defendants

violated Section 10(b) of the Exchange Act, Rule 10b-5 promulgated thereunder, and Section 20(a) of the

Exchange Act. The amended complaint asserted a class period of January 16, 2001, through July 16, 2002,

inclusive. The amended complaint alleged generally that, during the asserted class period, the Corporation

misrepresented the adequacy of its capital levels and loan loss allowance relating to higher risk assets. In

addition, the amended complaint alleged generally that the Corporation failed to disclose that it was experiencing

serious infrastructure deficiencies and systemic computer problems as a result of its growth.

On December 4, 2002, the Court granted defendants’ motion to dismiss plaintiffs’ amended complaint with leave

to amend. Pursuant to that order, plaintiffs filed a second amended complaint on December 23, 2002, which

asserted the same class period and alleged violations of the same statutes and rule. The second amended

complaint also added a new Individual Defendant and asserted violations of Generally Accepted Accounting

Principles. Defendants moved to dismiss the second amended complaint on January 8, 2003, and plaintiffs filed a

motion on March 6, 2003, seeking leave to amend their complaint. On April 10, 2003, the Court granted

defendants’ motion to dismiss plaintiffs’ second amended complaint, denied plaintiffs’ motion for leave to

amend, and dismissed the consolidated action with prejudice. Plaintiffs appealed the Court’s order, opinion, and

judgment to the United States Court of Appeals for the Fourth Circuit on May 8, 2003, and a briefing on the

appeal concluded in September 2003. Oral argument was held on February 25, 2004.

89