Capital One 2003 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2003 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.in its consolidated financial statements for the year ended December 31, 2002, and adopted the recognition and

measurement provisions in its consolidated financial statements for the year ended December 31, 2003. The

adoption of the recognition and measurement provisions of FIN 45 in 2003 did not have a material impact on the

consolidated earnings or financial position of the Company. See Note P, Commitments, Contingencies and

Guarantees.

In July of 2002, the FASB issued SFAS No. 146, Accounting for Costs Associated with Exit or Disposal

Activities (“SFAS 146”). SFAS 146 requires that a liability for a disposal obligation be recognized and measured

at its fair value when it is incurred rather than at the date the Company’s commits to an exit plan, and that

severance pay be recognized over time rather than up front unless certain conditions are met. The provisions of

SFAS 146 are effective for exit or disposal activities that are initiated after December 31, 2002. The adoption of

SFAS 146 did not have a material impact on the consolidated earnings or financial position of the Company.

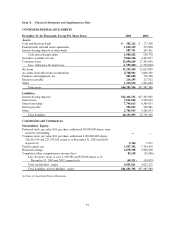

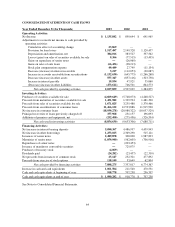

Cash and Cash Equivalents

Cash and cash equivalents includes cash and due from banks, federal funds sold and resale agreements and

interest-bearing deposits at other banks. Cash paid for interest for the years ended December 31, 2003, 2002 and

2001 was $1.6 billion, $1.4 billion, and $1.1 billion, respectively. Cash paid for income taxes for the years ended

December 31, 2003, 2002 and 2001 was $571.2 million, $585.8 million, and $70.8 million, respectively.

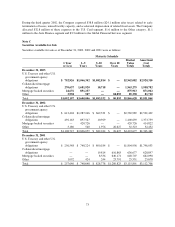

Securities Available for Sale

The Company classifies all debt securities as securities available for sale. These securities are stated at fair value,

with the unrealized gains and losses, net of tax, reported as a component of cumulative other comprehensive

income. The amortized cost of debt securities is adjusted for amortization of premiums and accretion of discounts

to maturity. Such amortization or accretion is included in interest income. Realized gains and losses on sales of

securities are determined using the specific identification method.

Revenue Recognition

The Company recognizes earned finance charges and fee income on loans according to the contractual provisions

of the credit agreements. When, based on historic performance of the portfolio, payment in full of finance charge

and fee income is not expected, the estimated uncollectible portion is not accrued as income. Amounts collected

on previously unrecognized or charged-off amounts related to finance charges and fees are recognized as income.

Costs to recover previously charged-off accounts are recorded as collection expense in “Other non-interest

expense”. Total finance charge and fee amounts billed but not accrued as income were $2.0 billion and $2.2

billion for the years ended December 31, 2003 and 2002, respectively.

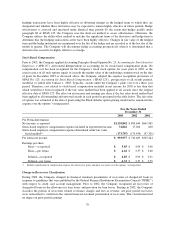

Interchange income is a fee paid by a merchant bank to the card-issuing bank through the interchange network.

Interchange fees are set by MasterCard International Inc. and Visa U.S.A. Inc. and are based on cardholder

purchase volumes. The Company recognizes interchange income as earned. The Company offers to its customers

certain rewards programs based on purchase volumes. The provision for the cost of the rewards programs is

based upon points awarded in the current year which are ultimately expected to be redeemed by program

members and the current average cost per point of redemption. The cost of these rewards programs is deducted

from interchange income. The cost of the rewards programs related to securitized loans is deducted from

servicing and securitizations income.

Annual membership fees and direct loan origination costs are deferred and amortized over one year on a straight-

line basis. Dealer fees and premiums are deferred and amortized over five years on a straight-line basis for auto

loan originations. Direct loan origination costs consist of both internal and external costs associated with the

origination of a loan. Deferred fees (net of deferred costs of $109.9 million and $94.3 million in 2003 and 2002,

respectively) were $319.8 million and $332.9 million as of December 31, 2003 and 2002, respectively.

67