Capital One 2003 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2003 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

hedging transactions have been highly effective in offsetting changes in the hedged items to which they are

designated and whether those derivatives may be expected to remain highly effective in future periods. Hedge

effectiveness is assessed and measured under identical time periods To the extent that hedges qualify under

paragraph 68 of SFAS 133, the Company uses the short-cut method to assess effectiveness. Otherwise, the

Company utilizes the dollar-offset method or matches the significant terms of the derivative and hedge item to

determine that the hedging transactions are/or have been highly effective. Changes in fair value of the hedged

item and the hedge instrument are maintained over the life of the hedge and are recorded as of the last day of the

month or quarter. The Company will discontinue hedge accounting prospectively when it is determined that a

derivative has ceased to be highly effective as a hedge.

Stock-Based Compensation

Prior to 2003, the Company applied Accounting Principles Board Opinion No. 25, Accounting for Stock Issued to

Employees (“APB 25”) and related Interpretations in accounting for its stock-based compensation plans. No

compensation cost has been recognized for the Company’s fixed stock options for years prior to 2003, as the

exercise price of all such options equals or exceeds the market value of the underlying common stock on the date

of grant. In December 2003 as discussed above, the Company adopted the expense recognition provisions of

SFAS No. 123, Accounting for Stock Based Compensation, (“SFAS 123”), prospectively to all awards granted,

modified, or settled after January 1, 2003. Typically, awards under the Company’s plans vest over a three year

period. Therefore, cost related to stock-based compensation included in net income for 2003 is less than that

which would have been recognized if the fair value method had been applied to all awards since the original

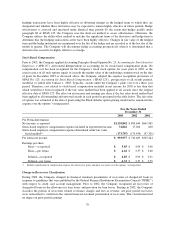

effective date of SFAS 123. The effect on net income and earnings per share if the fair value based method had

been applied to all outstanding and unvested awards in each period is presented in the table below. The fair value

of options was estimated at the date of grant using the Black-Scholes option-pricing model and is amortized into

expense over the options’ vesting period.

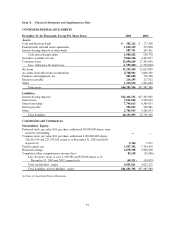

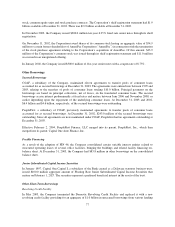

For the Years Ended

December 31

2003 2002 2001

Pro Forma Information

Net income, as reported $1,135,842 $ 899,644 $641,965

Stock-based employee compensation expense included in reported net income 31,842 17,204 610

Stock-based employee compensation expense determined under fair value

based method(1) (173,707) (174,439) (97,331)

Pro forma net income $ 993,977 $ 742,409 $545,244

Earnings per share:

Basic—as reported $5.05$ 4.09 $ 3.06

Basic—pro forma $4.42$ 3.37 $ 2.60

Diluted—as reported $4.85$ 3.93 $ 2.91

Diluted—pro forma $4.33$ 3.37 $ 2.55

(1) Includes amortization of compensation expense for current year grants and prior year grants over the options’ vesting period.

Change in Recoveries Classification

During 2002, the Company changed its financial statement presentation of recoveries of charged-off loans in

response to guidelines that were published by the Federal Financial Institutions Examination Council (“FFIEC”)

with respect to credit card account management. Prior to 2002, the Company recognized all recoveries of

charged-off loans in the allowance for loan losses and provision for loan losses. Starting in 2002, the Company

classifies the portion of recoveries related to finance charges and fees as revenue. All prior period recoveries

were reclassified to conform to the current financial statement presentation of recoveries. This classification had

no impact on prior period earnings.

70