Capital One 2003 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2003 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

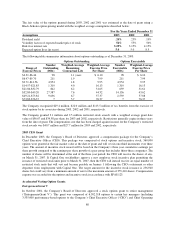

Additionally, federal banking laws exist that limit the ability of the Bank and the Savings Bank to transfer funds

to the Corporation. As of December 31, 2003, retained earnings of the Bank and the Savings Bank of $1.6 billion

and $426.7 million, respectively, were available for payment of dividends to the Corporation without prior

approval by the regulators. The Savings Bank, however, is required to give the OTS at least 30 days advance

notice of any proposed dividend and the OTS, in its discretion, may object to such dividend.

Note P

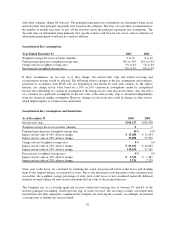

Commitments, Contingencies and Guarantees

Line of Credit Commitments

As of December 31, 2003, the Company had outstanding lines of credit of approximately $190.3 billion

committed to its customers. Of that total commitment, approximately $119.0 billion was unused. While this

amount represented the total available lines of credit to customers, the Company has not experienced, and does

not anticipate, that all of its customers will exercise their entire available line at any given point in time. The

Company generally has the right to increase, reduce, cancel, alter or amend the terms of these available lines of

credit at any time.

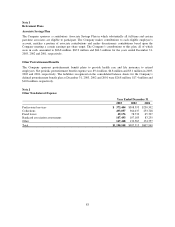

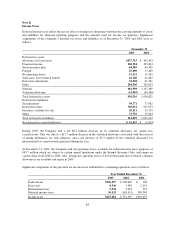

Lease Commitments

Certain premises and equipment are leased under agreements that expire at various dates through 2012, without

taking into consideration available renewal options. Many of these leases provide for payment by the lessee of

property taxes, insurance premiums, cost of maintenance and other costs. In some cases, rentals are subject to

increases in relation to a cost of living index. Total rent expenses amounted to approximately $63.7 million,

$63.2 million, and $64.7 million for the years ended December 31, 2003, 2002 and 2001, respectively.

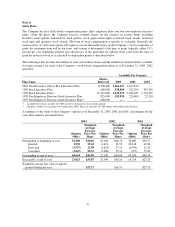

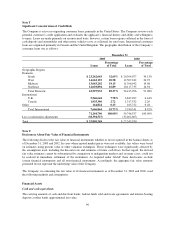

Future minimum rental commitments as of December 31, 2003, for all non-cancelable operating leases with

initial or remaining terms of one year or more are as follows:

2004 $ 40,041

2005 36,361

2006 31,903

2007 31,318

2008 31,090

Thereafter 48,873

Total $219,586

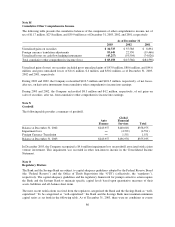

Guarantees

Residual Value Guarantees

The Company has entered into synthetic lease transactions to finance several facilities. A synthetic lease structure

typically involves establishing a special purpose vehicle (“SPV”) that owns the properties to be leased. The SPV

is funded and its equity is held by outside investors. In accordance with the FIN 46, these entities are evaluated to

determine whether they are variable interest entities and, if so, whether the Company is the primary beneficiary.

Variable interest entities for which the Company is the primary beneficiary are required to be consolidated.

Entities which are not determined to be variable interest and/or for which the Company is not deemed to be the

primary beneficiary are not required to be consolidated. Synthetic lease transactions, where the SPV is not

required to be consolidated, are treated as operating leases in accordance with SFAS No. 13, Accounting for

Leases.

In December 2000, the Company entered into a 10-year agreement for the lease of the headquarters building

being constructed in McLean, Virginia. The agreement called for monthly rent to commence upon completion,

88