Capital One 2003 Annual Report Download - page 66

Download and view the complete annual report

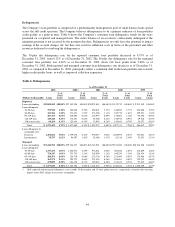

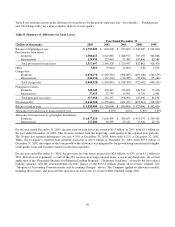

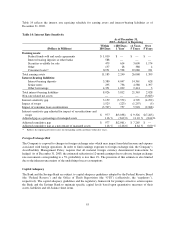

Please find page 66 of the 2003 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.During the years ended 2003 and 2002, the Company sold $1.9 billion and $1.5 billion, respectively of auto

loans. These transactions resulted in gains of $66.4 million and $28.2 million for the years ended December 31,

2003 and 2002, respectively, of which $56.9 and $24.6 were allocated to the Auto Finance segment while the

remainder was held in the Other category.

Net charge-offs of Auto Finance segment loans increased $141.4 million, or 65%, while average Auto Finance

loans for the year ended December 31, 2003 grew $2.1 billion, or 36%, compared to the same period in the prior

year. For the year ended December 31, 2003, the Auto Finance segment’s net charge-off rate was 4.62%

compared to 3.82% for the prior year. The increase was primarily driven by slower loan growth than the prior

year, general economic weakness and a continued softness in used car values.

The 30-plus day delinquency rate for the Auto Finance segment was 7.55% as of December 31, 2003, up 40 basis

points from 7.15% as of December 31, 2002. The increase in delinquencies was primarily the result of slower

loan growth and general economic weakness.

During 2002, the Company and the Auto Finance segment recognized compensation expense of $14.5 million

($9.0 million after taxes) related to the accelerated vesting provisions of certain restricted stock issued in

connection with the acquisition of PeopleFirst.

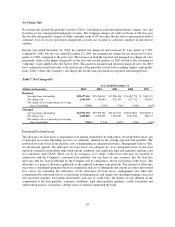

Global Financial Services Segment

The Global Financial Services segment consists of international lending activities, installment lending, small

business lending, patient financing and other investment businesses. Total Global Financial Services segment

loans increased 39% to $16.5 billion at December 31, 2003, compared to $11.9 billion at December 31, 2002.

The increase in total loans reflects the Company’s successful efforts to diversify its loan portfolio. Net income

contribution from the Global Financial Services segment for the year ended December 31, 2003, increased

$73.0 million, to $64.8 million, compared to the same period in the prior year. The improvement in the Global

Financial Services segment’s financial performance in 2003 was due to the maturation of many of the

Company’s diversification businesses in the U.S., U.K. and Canada.

Net charge-offs of Global Financial Services segment loans increased $176.8 million, or 50% while average

Global Financial Services segment loans for the year ended December 31, 2003 grew $3.7 billion, or 36%,

compared to the same period in the prior year. For the year ended December 31, 2003, the Global Financial

Services segment’s net charge-off rate was 3.83% compared to 3.49% for the prior year. The increase was driven

primarily by slower loan growth in the Company’s small business and international businesses compared to

2002.

The 30-plus day delinquency rate for the Global Financial Services segment was 2.70% as of December 31,

2003, down 38 basis points from 3.08% as of December 31, 2002. Global Financial Services delinquencies

decreased primarily as a result of the addition of higher credit quality loans to the portfolio.

During 2002, the Company realigned certain aspects of its European operations. Charges related to the

realignment of $12.5 million ($7.8 million after taxes) were recognized and allocated to the Global Financial

Services segment.

48