Capital One 2003 Annual Report Download - page 115

Download and view the complete annual report

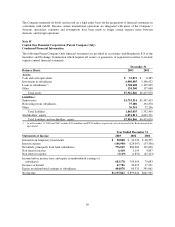

Please find page 115 of the 2003 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Securities available for sale

The fair value of securities available for sale was determined using current market prices. See Note C for fair

values by type of security.

Consumer loans

The net carrying amount of consumer loans other than auto loans approximated fair value due to the relatively

short average life and variable interest rates on a substantial number of these loans. This amount excluded any

value related to account relationships.

The fair value of auto loans was estimated by discounting future cash flows using a rate at which a similar

portfolio of loans would be made under current conditions.

Interest receivable

The carrying amount approximated the fair value of this asset due to its relatively short-term nature.

Accounts receivable from securitizations

The carrying amount approximated fair value.

Derivatives

The carrying amount of derivatives approximated fair value and was represented by the estimated unrealized

gains as determined by quoted market prices. This value generally reflects the estimated amounts that the

Corporation would have received to terminate the interest rate swaps, currency swaps and forward foreign

currency exchange (“f/x”) contracts at the respective dates, taking into account the forward yield curve on the

swaps and the forward rates on the currency swaps and f/x contracts. These derivatives are included in other

assets on the balance sheet.

Financial Liabilities

Interest-bearing deposits

The fair value of interest-bearing deposits was calculated by discounting the future cash flows using estimates of

market rates for corresponding contractual terms.

Other borrowings

The carrying amount of federal funds purchased and resale agreements and other short-term borrowings

approximated fair value. The fair value of secured borrowings was calculated by discounting the future cash

flows using estimates of market rates for corresponding contractual terms and assumed maturities when no stated

final maturity was available. The fair value of the junior subordinated capital income securities was determined

based on quoted market prices.

Senior notes

The fair value of senior notes was determined based on quoted market prices.

Interest payable

The carrying amount approximated the fair value of this asset due to its relatively short-term nature.

97