Capital One 2003 Annual Report Download - page 95

Download and view the complete annual report

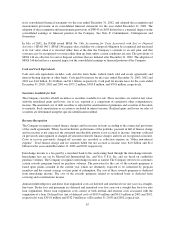

Please find page 95 of the 2003 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.stock, common equity units and stock purchase contracts. The Corporation’s shelf registration statement had $1.9

billion available at December 31, 2003. There was $2.2 billion available at December 31, 2002.

In November 2003, the Company issued $300.0 million ten-year 6.25% fixed rate senior notes through its shelf

registration.

On November 11, 2002, the Corporation issued shares of its common stock having an aggregate value of $54.9

million to certain former shareholders of AmeriFee Corporation (“AmeriFee”) in connection with the termination

of the stock purchase agreement relating to the Corporation’s acquisition of AmeriFee. Of this amount, $43.9

million of the Corporation’s common stock was issued through its shelf registration statement and $11.0 million

was issued in an unregistered offering.

In January 2002, the Company issued $300.0 million of five-year senior notes with a coupon rate of 8.75%.

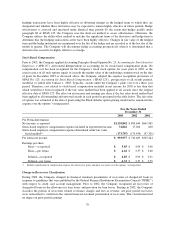

Other Borrowings

Secured Borrowings

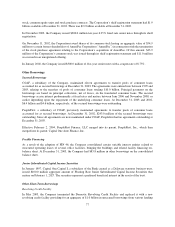

COAF, a subsidiary of the Company, maintained eleven agreements to transfer pools of consumer loans

accounted for as secured borrowings at December 31, 2003. The agreements were entered into between 1999 and

2003, relating to the transfers of pools of consumer loans totaling $10.0 billion. Principal payments on the

borrowings are based on principal collections, net of losses, on the transferred consumer loans. The secured

borrowings accrue interest predominantly at fixed rates and mature between June 2006 and November 2008, or

earlier depending upon the repayment of the underlying consumer loans. At December 31, 2003 and 2002,

$6.4 billion and $4.6 billion, respectively, of the secured borrowings were outstanding.

PeopleFirst, a subsidiary of COAF, previously maintained agreements to transfer pools of consumer loans

accounted for as secured borrowings. At December 31, 2002, $243.0 million of the secured borrowings were

outstanding. Since all agreements are now maintained under COAF, Peoplefirst had no agreements outstanding at

December 31, 2003.

Effective February 2, 2004, PeopleFirst Finance, LLC merged into its parent, PeopleFirst, Inc., which then

merged into its parent, Capital One Auto Finance, Inc.

Facility Financing

As a result of the adoption of FIN 46, the Company consolidated certain variable interest entities related to

structured operating leases of several office facilities, bringing the buildings and related facility financing on-

balance sheet. At December 31, 2003, the Company had $83.8 million in other borrowings on the consolidated

balance sheet.

Junior Subordinated Capital Income Securities

In January 1997, Capital One Capital I, a subsidiary of the Bank created as a Delaware statutory business trust,

issued $100.0 million aggregate amount of Floating Rate Junior Subordinated Capital Income Securities that

mature on February 1, 2027. The securities represent a preferred beneficial interest in the assets of the trust.

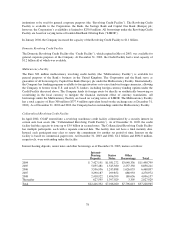

Other Short-Term Borrowings

Revolving Credit Facility

In May 2003, the Company terminated the Domestic Revolving Credit Facility and replaced it with a new

revolving credit facility providing for an aggregate of $1.0 billion in unsecured borrowings from various lending

77