Capital One 2003 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2003 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

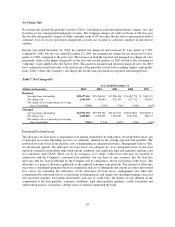

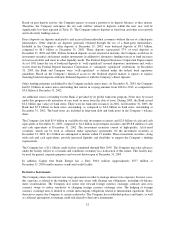

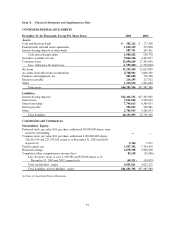

Table 14 reflects the interest rate repricing schedule for earning assets and interest-bearing liabilities as of

December 31, 2003.

Table 14: Interest Rate Sensitivity

As of December 31,

2003—Subject to Repricing

(Dollars in Millions)

Within

180 Days

>180 Days-

1Year

>1 Year-

5 Years

Over

5 Years

Earning assets:

Federal funds sold and resale agreements $ 1,010 $ — $ — $ —

Interest-bearing deposits at other banks 588 — — —

Securities available for sale 479 614 3,600 1,174

Other 157 28 388 4

Consumer loans(1) 8,951 1,598 22,080 221

Total earning assets 11,185 2,240 26,068 1,399

Interest-bearing liabilities:

Interest-bearing deposits 3,380 4,047 14,361 628

Senior notes 295 736 4,588 1,397

Other borrowings 4,351 1,029 2,414 3

Total interest-bearing liabilities 8,026 5,812 21,363 2,028

Non-rate related net assets — — — (3,663)

Interest sensitivity gap 3,159 (3,572) 4,705 (4,292)

Impact of swaps 1,525 (223) (1,297) (5)

Impact of consumer loan securitizations (3,707) 757 5,918 (2,968)

Interest sensitivity gap adjusted for impact of securitizations and

swaps $ 977 $(3,038) $ 9,326 $(7,265)

Adjusted gap as a percentage of managed assets 1.16 % (3.62)% 11.10 % (8.64)%

Adjusted cumulative gap $ 977 $(2,061) $ 7,265 $ —

Adjusted cumulative gap as a percentage of managed assets 1.16 % (2.46)% 8.64 % 0.00 %

(1) Reflects the repricing of interest rates on outstanding credit card loans within five years.

Foreign Exchange Risk

The Company is exposed to changes in foreign exchange rates which may impact translated income and expense

associated with foreign operations. In order to limit earnings exposure to foreign exchange risk, the Company’s

Asset/Liability Management Policy requires that all material foreign currency denominated transactions be

hedged. As of December 31, 2003, the estimated reduction in 12-month earnings due to adverse foreign exchange

rate movements corresponding to a 5% probability is less than 1%. The precision of this estimate is also limited

due to the inherent uncertainty of the underlying forecast assumptions.

Capital Adequacy

The Bank and the Savings Bank are subject to capital adequacy guidelines adopted by the Federal Reserve Board

(the “Federal Reserve”) and the Office of Thrift Supervision (the “OTS”) (collectively, the “regulators”),

respectively. The capital adequacy guidelines and the regulatory framework for prompt corrective action require

the Bank and the Savings Bank to maintain specific capital levels based upon quantitative measures of their

assets, liabilities and off-balance sheet items.

55