Capital One 2003 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2003 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

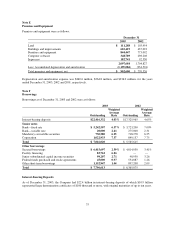

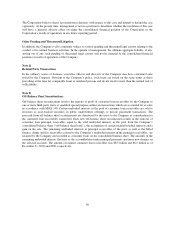

Note K

Income Taxes

Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets

and liabilities for financial reporting purposes and the amounts used for income tax purposes. Significant

components of the Company’s deferred tax assets and liabilities as of December 31, 2003 and 2002 were as

follows:

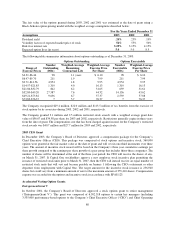

December 31

2003 2002

Deferred tax assets:

Allowance for loan losses $337,715 $ 442,393

Unearned income 260,324 323,404

Stock incentive plan 64,585 49,585

Foreign 25,890 17,469

Net operating losses 15,212 19,165

State taxes, net of federal benefit 42,140 61,649

Derivative instruments 32,228 61,491

Other 204,505 142,033

Subtotal 982,599 1,117,189

Valuation allowance (52,083) (60,368)

Total deferred tax assets 930,516 1,056,821

Deferred tax liabilities:

Securitizations 59,771 57,962

Deferred revenue 760,021 915,953

Securities available for sale 20,511 33,735

Other 73,756 53,964

Total deferred tax liabilities 914,059 1,061,614

Net deferred tax assets(liabilities) $ 16,457 $ (4,793)

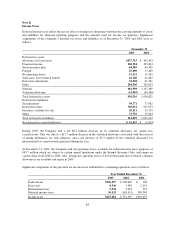

During 2003, the Company had a net $8.2 million decrease in its valuation allowance for certain loss

carryforwards. This was due to a $13.7 million decrease in the valuation allowance associated with the reversal

of timing differences for state purposes, and a net increase of $5.5 million of the valuation allowance for

international loss carryforwards generated during the year.

At December 31, 2003, the Company had net operating losses available for federal income taxes purposes of

$43.7 million which are subject to certain annual limitations under the Internal Revenue Code, and expire on

various dates from 2018 to 2020. Also, foreign net operating losses of $254.0 thousand (net of related valuation

allowances) are available and expire in 2009.

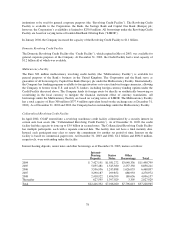

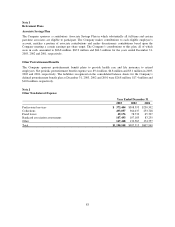

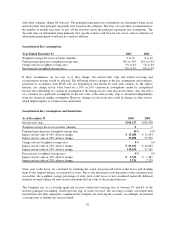

Significant components of the provision for income taxes attributable to continuing operations were as follows:

Year Ended December 31

2003 2002 2001

Federal taxes $596,397 $ 708,667 $ 138

State taxes 8,346 5,485 2,214

International taxes 5,914 2,654 555

Deferred income taxes 56,425 (165,411) 390,548

Income taxes $667,082 $ 551,395 $393,455

84