Capital One 2003 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2003 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Associate Stock Purchase Plan

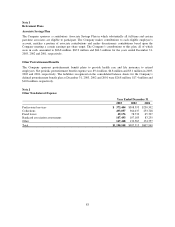

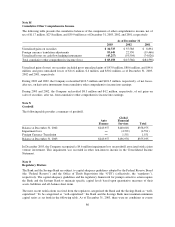

The Company maintains an Associate Stock Purchase Plan (the “Purchase Plan”). The Purchase Plan is a

compensatory plan under SFAS 123; accordingly the Company recognized $3.9 million in compensation expense

in 2003.

Under the Purchase Plan, associates of the Company are eligible to purchase common stock through monthly

salary deductions of a maximum of 15% and a minimum of 1% of monthly base pay. To date, the amounts

deducted are applied to the purchase of unissued common or treasury stock of the Company at 85% of the current

market price. Shares may also be acquired on the market. The Company terminated its 1995 Associate Stock

Purchase Plan in October 2002 when shares available for issuance under such plan were exhausted, and

implemented in substitution its 2002 Associate Stock Purchase Plan under substantially similar terms. An

aggregate of 3.0 million common shares has been authorized for issuance under the 2002 Associate Stock

Purchase Plan, of which 2.1 million shares were available for issuance as of December 31, 2003.

Dividend Reinvestment and Stock Purchase Plan

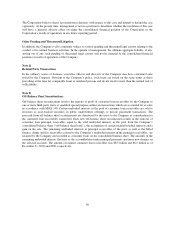

In 1997, the Company implemented its dividend reinvestment and stock purchase plan (“1997 DRP”), which

allows participating stockholders to purchase additional shares of the Company’s common stock through

automatic reinvestment of dividends or optional cash investments. The Company issued 10.4 thousand and 3.0

million shares of new common stock in 2003 and 2002, respectively, under the 1997 DRP. The Company also

instituted an additional dividend reinvestment and stock purchase plan in 2002 (“2002 DRP”) with an additional

7.5 million shares reserved, all of which were available for issuance at December 31, 2003.

Note H

Common and Preferred Shares

Share Repurchase Program

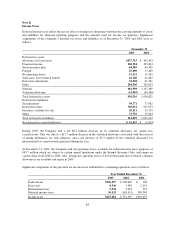

In July 1997, the Company’s Board of Directors voted to repurchase up to 6.0 million shares of the Company’s

common stock to mitigate the dilutive impact of shares issuable under its benefit plans, including the Purchase

Plan, dividend reinvestment plan and stock incentive plans. In July 1998 and February 2000, the Company’s

Board of Directors voted to increase this amount by 4,500,000 and 10,000,000 shares, respectively, of the

Company’s common stock. For the years ended December 31, 2003, and 2002, the Company did not repurchase

shares under this program. Certain treasury shares have been reissued in connection with the Company’s benefit

plans.

Cumulative Participating Junior Preferred Stock

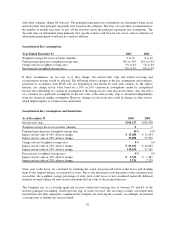

On November 16, 1995, the Board of Directors of the Company declared a dividend distribution of one Right for

each outstanding share of common stock. As amended, each Right entitles a registered holder to purchase from

the Company 1/300th of a share of the Company’s authorized Cumulative Participating Junior Preferred Stock

(the “Junior Preferred Shares”) at a price of $200 per 1/300th of a share, subject to adjustment. The Company has

reserved one million shares of its authorized preferred stock for the Junior Preferred Shares. Because of the

nature of the Junior Preferred Shares’ dividend and liquidation rights, the value of the 1/300th interest in a Junior

Preferred Share purchasable upon exercise of each Right should approximate the value of one share of common

stock. Initially, the Rights are not exercisable and trade automatically with the common stock. However, the

Rights generally become exercisable and separate certificates representing the Rights will be distributed, if any

person or group acquires 15% or more of the Company’s outstanding common stock or a tender offer or

exchange offer is announced for the Company’s common stock. Upon such event, provisions would also be made

so that each holder of a Right, other than the acquiring person or group, may exercise the Right and buy common

stock with a market value of twice the $200 exercise price. The Rights expire on November 29, 2005, unless

earlier redeemed by the Company at $0.01 per Right prior to the time any person or group acquires 15% of the

outstanding common stock. Until the Rights become exercisable, the Rights have no dilutive effect on earnings

per share.

82