Asus 2014 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2014 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.69

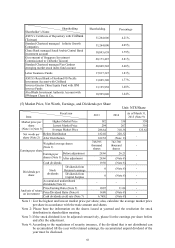

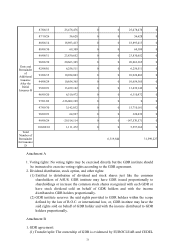

Note 5: Profit ratio = Closing price per share of the year / Earning per share.

Note 6: Earning ratio = Closing price per share of the year / Cash dividend per share

Note 7: Cash dividend yield rate = Cash dividend per share / Closing price per share of the year

Note 8: Subject to the approval of the annual shareholders meeting.

Note 9: The data collected up to March 31, 2015 were included in the report printed on April 15,

2015 for data accuracy.

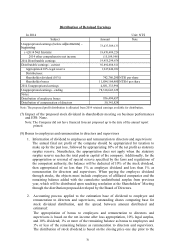

(6) Execution of Dividend Policy

1. Dividend Policy

The annual final net profit of the company should be appropriated for taxation to make up

for the past loss, followed by appropriating 10% of the net profit as statutory surplus

reserve. Nonetheless, the appropriation does not apply when the statutory surplus reserve

reaches the total paid-in capital of the company. Additionally, for the appropriation or

reversal of special reserve specified by the laws and regulations of the competent

authority, the balance will be deducted of 10% of the stock dividend , then appropriated

of no less than 1% as employee dividend and less than 1% as remuneration for directors

and supervisors. When paying the employee dividend through stocks, the objects must

include employees of affiliated companies and the remaining balance added with the

cumulative undistributed surplus from previous year, which will be distributed upon

reaching resolution at the Shareholders’ Meeting through the distribution proposal

developed by the Board of Directors.

In a turbulent industry environment, the company faces with a growing stage for its

corporate life cycle. In consideration of the company’s long-term financial plan and the

meeting shareholder demand for cash flow. The cash dividend issued each year shall not

remain lower than 10% of the sum of cash dividend and stock dividend. In the coming

one year, the aforementioned dividend policy shall apply.

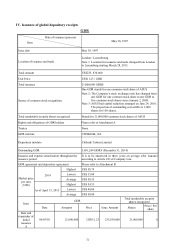

2. Proposed Distribution of Dividends:

(1) The 2014 net income after tax was NT$19,470,409,224; when added with other

comprehensive net income, the 2014 divisible earning became NT$19,455,299,678,

which added with the retained earnings of NT$73,437,309,133 from previous year to

yield a divisible earning of NT$92,892,608,811. After appropriating statutory surplus

reserve of NT$1,947,040,922, that was distributed in accordance with the “Articles of

Incorporation” as follows (Please refer to the distribution of retained earrings table

for details):

i. Shareholder dividend: NT$742,760,280, distributed in cash.

ii.Shareholder cash dividends: NT$11,884,164,480, distributed in cash.

(2) If shareholder’s cash dividend is less than NT$ 1, the distribution will be made in the

form of cash rounded and adjusted by a specific represent arranged by the Chairman

of the Board of Directors.

(3) For earnings distribution, in case of changes in outstanding shares that causes changes

in payout ratios and require modification, the shareholder meeting is hereby requested

to authorize the Board of Directors for process within the scope of the said amount

and stock shares.

(4) The Board of Directors is authorized upon the resolution of the general shareholder

meeting to define the dividend, distribution base date, and the related events.