Asus 2014 Annual Report Download - page 201

Download and view the complete annual report

Please find page 201 of the 2014 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268

|

|

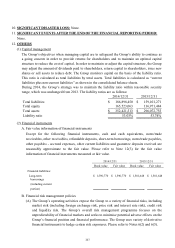

197

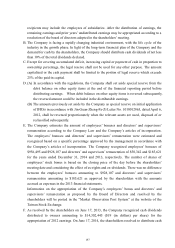

recipients may include the employees of subsidiaries. After the distribution of earnings, the

remaining earnings and prior years’ undistributed earnings may be appropriated according to a

resolution of the board of directors adopted in the shareholders’ meeting.

B. The Company is facing a rapidly changing industrial environment, with the life cycle of the

industry in the growth phase. In light of the long-term financial plan of the Company and the

demand for cash by the shareholders, the Company should distribute cash dividends of not less

than 10% of the total dividends declared.

C. Except for covering accumulated deficit, increasing capital or payment of cash in proportion to

ownership percentage, the legal reserve shall not be used for any other purpose. The amount

capitalized or the cash payment shall be limited to the portion of legal reserve which exceeds

25% of the paid-in capital.

D. (A) In accordance with the regulations, the Company shall set aside special reserve from the

debit balance on other equity items at the end of the financial reporting period before

distributing earnings. When debit balance on other equity items is reversed subsequently,

the reversed amount could be included in the distributable earnings.

(B) The amounts previously set aside by the Company as special reserve on initial application

of IFRSs in accordance with Jin-Guan-Zheng-Fa-Zi Letter No. 1010012865, dated April 6,

2012, shall be reversed proportionately when the relevant assets are used, disposed of or

reclassified subsequently.

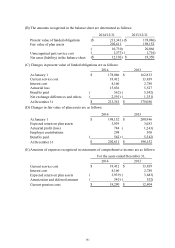

E. The Company estimates the amount of employees’ bonuses and directors’ and supervisors’

remuneration according to the Company Law and the Company’s articles of incorporation.

The employees’ bonuses and directors’ and supervisors’ remuneration were estimated and

recognized based on a specific percentage approved by the management in accordance with

the Company’s articles of incorporation. The Company recognized employees’ bonuses of

$956,495 and $928,107 and directors’ and supervisors’ remuneration of $50,342 and $185,621

for the years ended December 31, 2014 and 2013, respectively. The number of shares of

employees’ stock bonus is based on the closing price of the day before the shareholders’

meeting date and considering the effect of ex-rights and ex-dividends. There was no difference

between the employees’ bonuses amounting to $928,107 and directors’ and supervisors’

remuneration amounting to $185,621 as approved by the shareholders with the amounts

accrued as expenses in the 2013 financial statements.

Information on the appropriation of the Company’s employees’ bonus and directors’ and

supervisors’ remuneration as proposed by the Board of Directors and resolved by the

shareholders will be posted in the “Market Observation Post System” at the website of the

Taiwan Stock Exchange.

F. As resolved by the shareholders on June 17, 2013, the Company recognized cash dividends

distributed to owners amounting to $14,302,445 ($19 (in dollars) per share) for the

appropriation of 2012 earnings. On June 17, 2014, the shareholders resolved to distribute cash