Asus 2014 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2014 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268

|

|

178

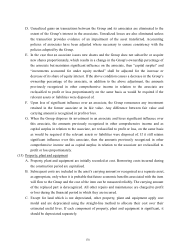

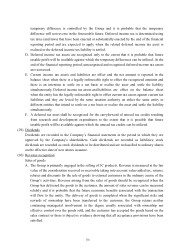

(1) Critical judgements in applying the Group’s accounting policies

A. Financial assets - impairment of equity investments

The Group follows the guidance of IAS 39 to determine whether a financial asset - equity

investment is impaired. This determination requires significant judgement. In making this

judgement, the Group evaluates, among other factors, the duration and extent to which the fair

value of an equity investment is less than its cost and the financial health of and short-term

business outlook for the investee, including factors such as industry and sector performance,

changes in technology and operational and financing cash flow.

B. Investment property

The Group uses the main part of the investment property to earn rentals or for capital

appreciation and others for its own use. When the portions cannot be sold separately and cannot

be leased separately under finance lease, the property is classified as investment property only

if the own-use portion accounts for less than 50% of the property.

C. Revenue recognition on a net/gross basis

The determination of whether the Group is acting as principal or agent in a transaction is based

on an evaluation of the Group’s exposure to the significant risks and rewards associated with

the sale of goods in accordance with the business model and substance of the transaction.

Where the Group acts as a principal, the amount received or receivable from customers is

recognized as revenue on a gross basis. Where the Group acts as an agent, net revenue is

recognized representing commissions earned.

The following characteristics of a principal are used as indicators to determine whether the

Group shall recognize revenue on a gross basis:

(A) The Group has primary responsibilities for the goods or services it provides;

(B) The Group bears inventory risk;

(C) The Group has the latitude in establishing prices for the goods or services, either directly or

indirectly.

(D) The Group bears credit risk of customers.

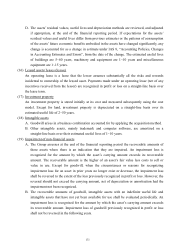

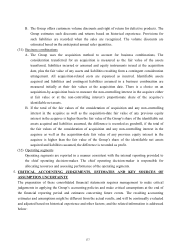

(2) Critical accounting estimates and assumptions

A. Estimation of sales returns and discounts

The Group estimates discounts and returns based on historical results and other known factors.

Provisions for such liabilities are recorded as a deduction item to sales revenues when the sales

are recognized. The Group reassesses the reasonableness of estimates of discounts and returns

periodically.

As of December 31, 2014, provisions for discounts and returns amounted to $18,708,316.

B. Estimation of provisions for warranty

The Group estimates provisions for warranty based on historical results. Provisions for such

liabilities are recorded as costs. The Group reassesses the reasonableness of estimates of

provisions for warranty periodically.

As of December 31, 2014, provisions for warranty amounted to $11,454,228.