Asus 2014 Annual Report Download - page 265

Download and view the complete annual report

Please find page 265 of the 2014 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268

|

|

261

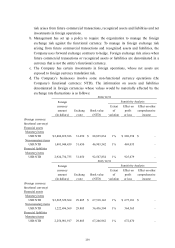

b. No credit limits were exceeded during 2014 and 2013, and management does not expect

any significant losses from non-performance by these counterparties.

c. The credit quality information of financial assets that are neither past due nor impaired,

the aging analysis of financial assets that were past due but not impaired and the

individual analysis of financial assets that had been impaired is provided in the

statement for each type of financial assets as described in Note 6.

(B) Liquidity risk

a. Cash flow forecasting is performed in the operating entities of the Company and

aggregated by the Company treasury to monitor rolling forecasts of the Company’s

liquidity requirements and ensure it has sufficient cash to meet operational needs while

maintaining sufficient headroom at all times. Such forecasting takes into consideration

the Company’s cash flow plans and compliance with internal balance sheet ratio targets.

b. The Company’s treasury invests surplus cash in demand deposits, time deposits, money

market deposits and marketable securities, choosing instruments with appropriate

maturities or sufficient liquidity to provide sufficient headroom as determined by the

abovementioned forecasts. At December 31, 2014 and 2013, the Company held financial

assets at fair value through profit or loss of $3,420,751 and $7,537,906, respectively,

that are expected to readily generate cash inflows for managing liquidity risk.

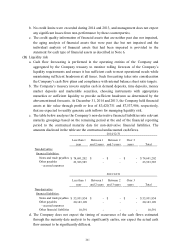

c. The table below analyses the Company’s non-derivative financial liabilities into relevant

maturity groupings based on the remaining period at the end of the financial reporting

period to the contractual maturity date for non-derivative financial liabilities. The

amounts disclosed in the table are the contractual undiscounted cash flows.

d. The Company does not expect the timing of occurrence of the cash flows estimated

through the maturity date analysis to be significantly earlier, nor expect the actual cash

flow amount to be significantly different.

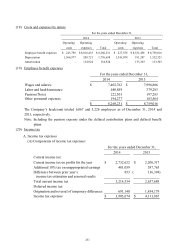

Less than 1

year

Between 1

and 2 years

Between 2

and 3 years

Over 3

years

Total

Non-derivative

financial liabilities:

Notes and trade payables

74,691,202$ -$ -$ -$ 74,691,202$

Other payables

- accrued expenses

23,523,585 - - - 23,523,585

2014/12/31

Less than 1

year

Between 1

and 2 years

Between 2

and 3 years

Over 3

years

Total

Non-derivative

financial liabilities:

Notes and trade payables 53,931,854$ -$ -$ -$ 53,931,854$

Other payables

- accrued expenses

20,143,109 - - - 20,143,109

Other financial liabilities

10,591 - - - 10,591

2013/12/31