Asus 2014 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2014 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

188

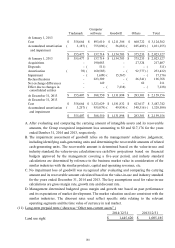

A. After evaluating and comparing the carrying amount of intangible assets and its recoverable

amounts, the Group recognized impairment loss amounting to $0 and $17,176 for the years

ended Dember 31, 2014 and 2013, respectively.

B. The impairment assessment of goodwill relies on the managements’ subjective judgement,

including identifying cash-generating units and determining the recoverable amounts of related

cash-generating units. The recoverable amount is determined based on the value-in-use and

industry standard, the value-in-use calculations use cash flow projections based on financial

budgets approved by the management covering a five-year period, and industy standard

calculations are determined by reference to the business market value in consideration of the

similar industries with the similar products, capital and operating revenues, etc.

C. No impairment loss of goodwill was recognized after evaluating and comparing the carrying

amount and its recoverable amount calculated based on the value-in-use and industry standard

for the years ended December 31, 2014 and 2013. The key assumptions used for value-in-use

calculations are gross margin rate, growth rate and discount rate.

D. Management determined budgeted gross margin and growth rate based on past performance

and its expectations of market development. The market valuation used are consistent with the

similar industries. The discount rates used reflect specific risks relating to the relevant

operating segments and the time value of currency in real market.

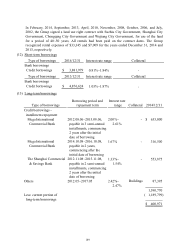

(11) Long-term prepaid rents ( shown as “Other non-current assets” )

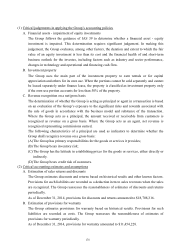

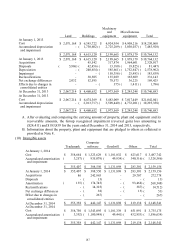

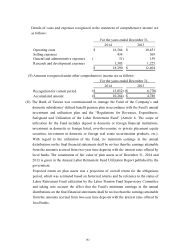

Computer

Trademark software Goodwill Others Total

At January 1, 2013

Cost 358,664$ 893,610$ 1,211,386$ 660,722$ 3,124,382$

Accumulated amortisation 3,187)( 755,896)( 56,683)( 285,489)( 1,101,255)(

and impairment

355,477$ 137,714$ 1,154,703$ 375,233$ 2,023,127$

At January 1, 2013 355,477$ 137,714$ 1,154,703$ 375,233$ 2,023,127$

Acquisitions - 190,083 - 27,324 217,407

Disposals - 511)( - - 511)(

Amortisation 70)( 160,585)( - 92,777)( 253,432)(

Impairment - 1,609)( 15,567)( - 17,176)(

Reclassifications - 223,309 - 26,541)( 196,768

Net exchange differences - 149 - 62 211

Effect due to changes in - - 7,238)( - 7,238)(

consolidated entities

At December 31, 2013 355,407$ 388,550$ 1,131,898$ 283,301$ 2,159,156$

At December 31, 2013

Cost 358,664$ 1,323,629$ 1,181,832$ 623,617$ 3,487,742$

Accumulated amortisation 3,257)( 935,079)( 49,934)( 340,316)( 1,328,586)(

and impairment

355,407$ 388,550$ 1,131,898$ 283,301$ 2,159,156$

2014/12/31 2013/12/31

Land use right 1,445,620$ 1,005,185$