Asus 2014 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2014 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268

|

|

173

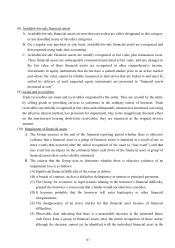

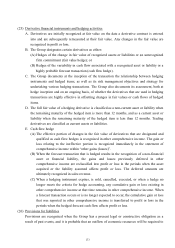

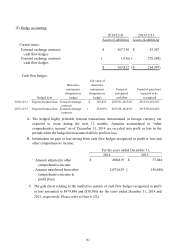

(25) Derivative financial instruments and hedging activities

A. Derivatives are initially recognized at fair value on the date a derivative contract is entered

into and are subsequently remeasured at their fair value. Any changes in the fair value are

recognized in profit or loss.

B. The Group designates certain derivatives as either:

(A) Hedges of the change in fair value of recognized assets or liabilities or an unrecognized

firm commitment (fair value hedge); or

(B) Hedges of the variability in cash flow associated with a recognized asset or liability or a

highly probable forecast transaction (cash flow hedge).

C. The Group documents at the inception of the transaction the relationship between hedging

instruments and hedged items, as well as its risk management objectives and strategy for

undertaking various hedging transactions. The Group also documents its assessment, both at

hedge inception and on an ongoing basis, of whether the derivatives that are used in hedging

transactions are highly effective in offsetting changes in fair values or cash flows of hedged

items.

D. The full fair value of a hedging derivative is classified as a non-current asset or liability when

the remaining maturity of the hedged item is more than 12 months, and as a current asset or

liability when the remaining maturity of the hedged item is less than 12 months. Trading

derivatives are classified as current assets or liabilities.

E. Cash flow hedge

(A) The effective portion of changes in the fair value of derivatives that are designated and

qualified as cash flow hedges is recognized in other comprehensive income. The gain or

loss relating to the ineffective portion is recognized immediately in the statement of

comprehensive income within “other gains (losses)”.

(B) When the forecast transaction that is hedged results in the recognition of a non-financial

asset or financial liability, the gains and losses previously deferred in other

comprehensive income are reclassified into profit or loss in the periods when the asset

acquired or the liability assumed affects profit or loss. The deferred amounts are

ultimately recognized in sales revenue.

(C) When a hedging instrument expires, is sold, cancelled, executed, or when a hedge no

longer meets the criteria for hedge accounting, any cumulative gain or loss existing in

other comprehensive income at that time remains in other comprehensive income. When

a forecast transaction occurs or is no longer expected to occur, the cumulative gain or loss

that was reported in other comprehensive income is transferred to profit or loss in the

periods when the hedged forecast cash flow affects profit or loss.

(26) Provisions for liabilities

Provisions are recognized when the Group has a present legal or constructive obligation as a

result of past events, and it is probable that an outflow of economic resources will be required to