Asus 2014 Annual Report Download - page 242

Download and view the complete annual report

Please find page 242 of the 2014 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

238

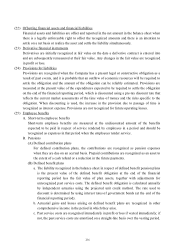

it arises from initial recognition of goodwill or of an asset or liability in a transaction other

than a business combination that at the time of the transaction affects neither accounting nor

taxable profit or loss. Deferred income tax is provided on temporary differences arising on

investments in subsidiaries and associates, except where the timing of the reversal of the

temporary difference is controlled by the Company and it is probable that the temporary

difference will not reverse in the foreseeable future. Deferred income tax is determined using

tax rates (and laws) that have been enacted or substantially enacted by the end of the

financial reporting period and are expected to apply when the related deferred income tax

asset is realized or the deferred income tax liability is settled.

D. Deferred income tax assets are recognized only to the extent that it is probable that future

taxable profit will be available against which the temporary differences can be utilized. At

each end of the financial reporting period, unrecognized and recognized deferred income tax

assets are reassessed.

E. Current income tax assets and liabilities are offset and the net amount is reported in the

balance sheet when there is a legally enforceable right to offset the recognized amounts and

there is an intention to settle on a net basis or realize the asset and settle the liability

simultaneously. Deferred income tax assets and liabilities are offset on the balance sheet

when the entity has the legally enforceable right to offset current tax assets against current

tax liabilities and they are levied by the same taxation authority on either the same entity or

different entities that intend to settle on a net basis or realize the asset and settle the liability

simultaneously.

F. A deferred tax asset shall be recognized for the carryforward of unused tax credits resulting

from research and development expenditures to the extent that it is possible that future

taxable profit will be available against which the unused tax credits can be utilized.

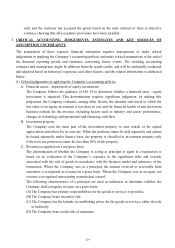

(27) Dividends

Dividends are recorded in the Company’s financial statements in the period in which they are

approved by the Company’s shareholders. Cash dividends are recorded as liabilities; stock

dividends are recorded as stock dividends to be distributed and are reclassified to ordinary shares

on the effective date of new shares issuance.

(28) Revenue recognition

Sales of goods

The Company is primarily engaged in the selling of 3C products. Revenue is measured at the fair

value of the consideration received or receivable taking into account value-added tax, returns,

rebates and discounts for the sale of goods to customers in the ordinary course of the Company’s

activities. Revenue arising from the sales of goods should be recognized when the Company has

delivered the goods to the customer, the amount of sales revenue can be measured reliably and it

is probable that the future economic benefits associated with the transaction will flow to the

entity. The delivery of goods is completed when the significant risks and rewards of ownership

have been transferred to the customer, the Company retains neither continuing managerial

involvement to the degree usually associated with ownership nor effective control over the goods