Experian 2007 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2007 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

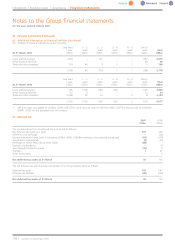

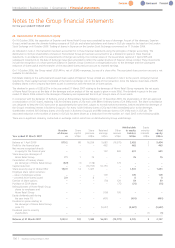

24. Retirement benefit assets/obligations (continued)

(a) Defined Benefit Schemes (continued)

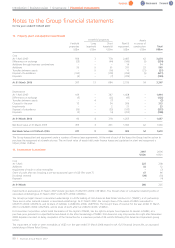

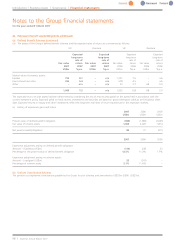

(vi) Changes in the present value of the defined benefit obligation are as follows:

2007 2006

US$m US$m

Opening defined benefit obligation 1,989 2,026

Demerger of Home Retail Group (1,100) –

Pension liability disposed with the sale of overseas businesses –(240)

Current service cost 53 70

Interest cost 78 91

Settlement or curtailment (9) (4)

Contributions paid by employees 14 16

Contributions paid from outside the Group 2–

Actuarial (gain)/loss on liabilities (118) 228

Benefits paid (123) (48)

Exchange differences 198 (150)

Closing defined benefit obligation 984 1,989

The total defined benefit obligation of US$984m (2006: US$1,989m) includes US$928m (2006: US$1,920m) in respect of the Group’s funded

arrangements and US$56m (2006: US$69m) in respect of the Group’s unfunded arrangements.

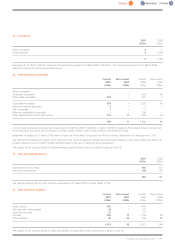

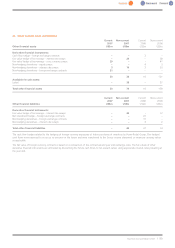

(vii) Changes in the market value of the plan assets are as follows:

2007 2006

US$m US$m

Opening market value of plan assets 2,020 1,814

Demerger of Home Retail Group (1,141) –

Pension assets disposed with the sale of overseas businesses –(195)

Expected return 107 105

Settlement or curtailment (3) (4)

Actuarial (loss)/gain on assets (53) 241

Contributions paid by the Group 38 232

Contributions paid by employees 14 16

Contributions paid from outside the Group 2–

Benefits paid (123) (48)

Exchange differences 208 (141)

Closing market value of plan assets 1,069 2,020

The actual returnon plan assets was US$54m (2006: US$346m).

Contributions in the year ended 31 March 2006 included a special contribution of US$179m paid into the Argos Pension Scheme in March 2006.

The estimated amount of contributions expected to be paid to the Experian pension schemes during the next financial year is US$19m by the Group

and US$7m by employees.

Introduction | Business review | Governance | Financial statements

Notes to the Group financial statements

for the year ended 31 March 2007

96 |Experian Annual Report2007