Experian 2007 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2007 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Experian Americas

24 | Experian Annual Report 2007

Operational review

Experian Americas delivered a strong

performance, more than offsetting

challenges in some markets. There

was excellent EBIT margin

progression, with all principal

activities improving year-over-year.

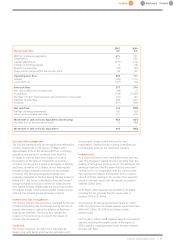

Credit Services

Includes consumer credit and business information

bureaux in the US and Canada, commercial lending

software and automotive services

Sales in Credit Services were up 5% in total during the

year, up 3% on an organic basis. Against tough

comparatives in 2006 (H1 2005/6 +18%, H2 +9%),

consumer credit services performed well, improving as

the year progressed. During the year, the business

demonstrated its resilience as clients shifted spend

towards account management and collections. Latterly

there has been improvement in customer acquisition

activity. Business information delivered a good

performance, reflecting expanded relationships with

several top ten banks and robust double-digit growth in

portfolio management products. Automotive did well on

the back of increased traction of its AutoCheck vehicle

history report and Autocount products. AutoCheck, for

example, secured a significant renewal from eBay

Motors. There was strong double-digit growth from

Baker Hill’s commercial lending software as it leveraged

Experian’s business information relationships.

VantageScore, the new credit score jointly developed by

the three US credit bureaux, has performed well in its first

year of deployment and to date has secured over 1,300

clients in test. The integration of the Canadian consumer

database, acquired in September 2006, is proceeding well

and is on track for launch later this year. While small, this

will enhance the service offered to Experian’s US clients,

many of whom are active in Canada.

Decision Analytics

Includes credit analytics, decision support

software and fraud solutions

Decision Analytics performed particularly well over the

year, with sales up 29%, reflecting increased market

penetration of both decision support software and fraud

prevention tools. The relationship with Bank of America

has continued to develop, as Experian becomes a

provider of enterprise-wide solutions, supporting Bank of

America across its credit and deposit products.

Fraud prevention delivered very strong double-digit

growth, as demand for Experian’s identity verification

solutions has increased, driven by the launch of Precise

ID, its new fraud detection product. There was increased

adoption amongst financial services companies and a

major client win in the Internet payment space.

Marketing Solutions

Includes data and data management (consumer data,

list processing and data integrity (including QAS),

database management and analytics), digital services

(CheetahMail), research services (Simmons and Vente),

and business strategies

Sales in Marketing Solutions were flat year-on-year and

marginally down (2%) on an organic basis. Marketing

Solutions continues to show divergent trends, with

declines in the traditional activities (consumer data, list

processing and database management), offsetting very

strong double-digit sales growth across Digital Services,

Research Services and QAS. Traditional activities, which

in the year still accounted for over 50% of Marketing

Solutions sales, have been impacted by the secular shift

in marketing spend to new digital channels.

Progress in the newer marketing areas is highly

encouraging. For example, CheetahMail delivered record

email volumes during the year (20 billion permission-

based messages), Simmons delivered strong growth in

syndicated research sales following new client wins and

QAS’ early foothold in the US has expanded rapidly.

Introduction | Business review | Governance | Financial statements

29

%

Sales in Decision

Analytics in Experian

Americas were

up 29%