Experian 2007 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2007 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Interactive

Includes Consumer Direct (online credit reports, scores

and monitoring services) and lead generation businesses:

LowerMyBills (mortgages), PriceGrabber (comparison

shopping) and ClassesUSA (online education)

Sales in Interactive grew by 37% during the year,

contributing 38% of total Americas sales from continuing

activities. Organic growth was 20%, with the balance of

17% from acquisitions (mainly PriceGrabber).

Consumer Direct delivered excellent growth throughout

the period, with strong demand from consumers for

credit monitoring services, which led to higher

membership rates. Meanwhile, increased focus on

enhancing the customer experience resulted in

significantly reduced churn rates. PriceGrabber delivered

very strong growth year-on-year, including a seasonal

boost in December, at which point unique visitors hit

record numbers. In the education vertical, growth at

ClassesUSA accelerated over the year, as it benefited from

shared expertise in online advertising with our other lead

generation properties.

Sales at LowerMyBills were impacted in the final quarter

by the downturn in US sub-prime lending, as lenders

either exited the market or considerably tightened lending

criteria (Q3 sales unchanged, Q4 down 8%). LowerMyBills

traditionally derives some 80% of sales from the sale of

mortgage leads to sub-prime lenders. However, there was

double-digit growth in EBIT in the year as a whole, as

LowerMyBills optimised marketing spend to generate

more profitable leads. In this challenging environment,

LowerMyBills continues to focus on marketing spend

efficiency and is driving sales through sales of higher

quality leads and diversification into both non sub-prime

and non mortgage-related products.

Financial review

Sales from continuing activities were $1,990m, up 15%

compared to the same period last year, with organic

growth of 8%. Acquisitions, predominantly in the

Interactive segment, contributed 7% to sales growth.

EBIT from direct businesses was $508m (2006: $404m), an

increase of 26% in the year, giving an EBIT margin of

25.5% (2006: 23.3%). Margins improved across all

business segments, reflecting growing scale in Decision

Analytics and the newer areas of Marketing Solutions,

continuing operating efficiencies and the positive impact

of last year’s affiliate credit bureau acquisitions.

EBIT from FARES, the 20%-owned real estate information

associate, reduced in the period to $61m, compared to

$69m last year. This was primarily due to the decline in US

mortgage originations. The improved profit performance in

the second half of the year is attributable to a less difficult

mortgage origination market and continued cost action

by FARES.

Experian Annual Report 2007 | 25

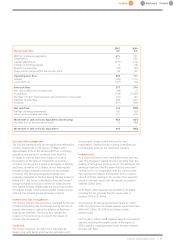

12 months to 31 March 2007 2006 Growth Organic

$m $m % growth

%

Sales

- Credit Services 804 766 5 3

- Decision Analytics 82 63 29 29

- Marketing Solutions 353 355 - (2)

- Interactive 751 547 37 20

Total – continuing activities 1,990 1,731 15 8

Discontinuing activities14 73 na

Total Americas 1,994 1,804 10

EBIT

- Direct business 508 404 26

- FARES 61 69 (11)

Total – continuing activities 569 473 20

Discontinuing activities1(7) 6 na

Total Americas 562 479 18

EBIT margin225.5% 23.3%

1 Discontinuing activities include MetaReward

2 EBIT margin is for continuing direct business only and excludes FARES