Experian 2007 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2007 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We have made excellent progress

during the year against our strategic,

operational and financial objectives.

The demerger from GUS was a

significant milestone in the

development of Experian, allowing

investors to benefit directly from the

future growth of the company and

our employees to become

shareholders. The £800m raised from

both new and existing shareholders

provides us with financial flexibility

and will help to underpin our growth.

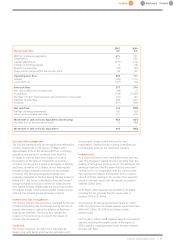

Delivery against financial objectives

Over the past year, we have delivered against our key

financial objectives. We have driven growth in both sales

and profits, with organic sales growth of 8% and a

further improvement in EBIT margins in our continuing

business, excluding FARES. All three regions delivered

good organic sales growth, reflecting the strength of our

portfolio. Our cash flow was strong and we converted

97% of EBIT into operating cash flow, ahead of

our target.

Acquisitions made in the four years to March 2006

together delivered double-digit post-tax returns in the

year to March 2007. The more recent acquisitions are

trading to plan.

Clear strategic progress

Our strategic priority at Experian is to continue to deliver

sustainable growth in order to create lasting shareholder

value. To facilitate this, we focus on our primary growth

drivers, and good progress was made against these over

the past year:

• Deeper client relationships - we won a number of new

mandates from existing clients. For example, we

renewed and expanded contracts with seven of the

top ten US banks.

• Geographic expansion - we have continued to expand

in markets outside the US and the UK, with significant

new client wins in many countries, including Spain,

France, Japan, China and South Africa.

• Product innovation - we continue to focus on product

innovation, introducing over 20 new products during

the year, including Precise ID, a new fraud detection

platform; MicroMarketer G3, the latest generation of

Experian’s global market segmentation system; and

Simmons online market research.

• Vertical expansion - we have strengthened our position

in new and expanding market sectors, including

telecommunications, government, retail and media.

For example, Experian is now a provider of credit

and decisioning services to all top five wireless

telecommunications companies in the UK.

22 | Experian Annual Report 2007

Progress in 2007

Introduction | Business review | Governance | Financial statements

We spent $82

million on

acquisitions

during the year

$

82m