Experian 2007 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2007 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54 |Experian Annual Report 2007

Introduction | Business review | Governance |Financial statements

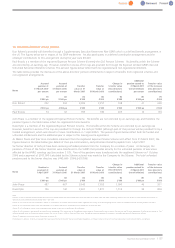

The GUS exercise prices represent the average of the middle market quotations of a GUS share as derived from the Daily Official List of The

London Stock Exchange for the three immediately preceding dealing days to the date on which options were originally granted. Options

granted under the GUS Executive Share Option Schemes which were granted before 2005 were exchanged for equivalent options over

Experian shares. Unvested options granted in 2005 and 2006 (other than options granted under the GUS 1998 Approved Executive Share

Option Scheme) were automatically exchanged for equivalent options over Experian shares. The performance condition for options granted

in 2005 and 2006 is based on the growth of Experian’s Earnings per Share in excess of the UK Retail Price Index from the date of demerger.

The market price of Experian Group Limited shares at the end of the financial year was 585.5p; the highest and lowest prices during the

financial year were 631.5p and 559.5p respectively.

SAYE share option scheme

Details of awards to directors under the GUS plc SAYE share option scheme are as follows:

Chairman

John Peace 4,394 – 4,394 384.0p 1009p – – – 01.05.06–31.10.06 –

Executive directors

Paul Brooks 1,454 – – 648.0p – 2,488 – 378.6p 01.09.07–29.02.08 2,488

Non-executive directors

David Tyler 4,394 – 4,394 384.0p 1035p – – – 01.05.06–31.10.06 –

Former directors

Sir Victor Blank 4,394 – 4,394 384.0p 1035p – – – 01.05.06–31.10.06 –

Oliver Stocken 4,394 – 4,394 384.0p 1035p – – – 01.05.06–31.10.06 –

Notes

1. Paul Brooks also participated in the US s.423 plan whilst he was based in the US. He currently holds 296 shares under the 2005 plan cycle and 463 shares under the 2006 plan cycle in addition to those in the above table.

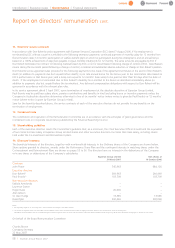

7. Experian ESOP Trust

As at 31 March 2007, the executive directors were, together with other employees of the Experian Group, discretionary beneficiaries under

the Experian Group Limited Employee Share Trust and, as such, each director is deemed to be interested in 13,419,683 ordinary shares in

Experian Group Limited held by the trustee of the Trust.

Number of

options at

1April 2006

Date from which

exercisable/expiry date

Total

number

of options

at 31

March

2007

Options

granted

pre-

demerger

(over GUS

plc shares)

Options

exercised

prior to

demerger

Original

GUS

exercise

price

GUS

share

price on

date of

exercise

Options

rolled

over into

Experian

shares

Options

exercised

following

demerger

New

Experian

exercise

price

Report on directors’ remuneration cont.