Experian 2007 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2007 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Continued investment in business

We continue to invest organically in the business to drive

growth. During the year, this included development in

emerging markets, specifically Asia Pacific, and new

product initiatives. Future organic investment will include

further emerging markets development, the establishment

of a near-shore facility in Chile, and investment in the

Canadian bureau. In the year to March 2008, much of

this investment will be weighted towards the first half.

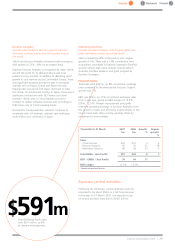

Capital expenditure in the year was $275m (2006

$212m). Of this, $20m relates to an accelerated

technology spend on data centre consolidation in the US,

which will enhance efficiency and productivity. We expect

capital expenditure in the current year to be broadly in

line with last year.

We also take advantage of opportunities to accelerate

growth and improve productivity through selective,

targeted acquisitions. In the year under review, we made

a number of small acquisitions which complement our

existing portfolio. Acquisition spend in the year was

$82m, excluding deferred consideration paid, and

included:

•Two new credit bureaux, in Canada and Estonia,

expanding our geographic footprint.

•An additional US credit bureau affiliate.

•Three new Marketing Solutions businesses.

•A minority stake in Sinotrust, a business information

and market research company in China.

Since the year-end, we have agreed to acquire Hitwise, a

leading online marketing intelligence company, for

$240m. This acquisition, which forms part of our strategy

to reposition Marketing Solutions, will bring a rapidly

growing, successful business to Experian, and new unique

data. Other acquisitions since the year end include

Informarketing, a direct marketing services provider in

Brazil; Emailing Solution, a leading French permission-

based email marketing company; and Tallyman, a

collections management software business. We expect a

low single-digit contribution to sales growth from

acquisitions in the year to March 2008.

Evolution of leadership to drive

future success

Experian has considerable opportunities for

future growth, in particular as demand

increases for our services from multinational

companies and within emerging markets. In order

to give sharper focus to all our regions of operation, we

have created a number of new senior leadership roles. In

addition to our two major regions in the Americas and UK

and Ireland, we now have dedicated senior managers for

EMEA, Asia Pacific and India respectively (although for

reporting purposes these regions will continue to be

combined). Our new leaders in EMEA and Asia Pacific are

tasked with driving our presence in these important areas.

Following 24 years of strong leadership contribution, John

Saunders, Experian’s Chief Executive Officer of Global

Operations, has announced his retirement after a

transitional handover period. John’s achievements within

Experian have been considerable, having created a client-

driven organisation focused on innovation, and we thank

John for his enormous contribution.

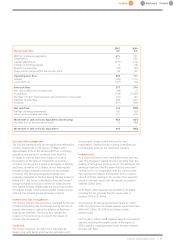

Second dividend of 11.5 cents, to give

full-year dividend of 17 cents

The Board of Experian has announced a dividend of 11.5

cents per share to give a full year dividend of 17 cents per

share. Based on continuing pro forma Benchmark EPS this

represents cover of just over three times.

Experian Annual Report 2007 | 23

Experian’s full-year dividend

was 17 cents per share

17

c