Experian 2007 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2007 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The directors present their report and the audited financial

statements for the year ended 31 March 2007.

Demerger

On 10 October 2006, GUS plc (now called Experian

Finance plc) separated its Experian business from its Home

Retail Group business by way of demerger. As part of the

demerger, Experian Group Limited became the ultimate

holding company of GUS plc and related subsidiaries and

shares in GUS plc ceased to be listed on the London Stock

Exchange on 6 October 2006. Experian Group Limited

was incorporated and registered on 30 June 2006 under

the Companies (Jersey) Law 1991 as a public company

limited by shares. Shares in Experian Group Limited were

admitted to the UK Listing Authority’s Official List and

trading on the London Stock Exchange’s market for listed

securities commenced on 11 October 2006.

Principal activities and business review

Experian is a global leader in providing information

solutions to business clients and consumers. It helps

organisations to find new customers and develop and

manage existing relationships by providing data, decision

making solutions and processing services. It also helps

consumers to understand, manage and protect their

personal information and make more informed purchase

decisions. A review of the results for the year and an

indication of future developments appear on pages 16 to

37. Research and development investment has been a

high priority for Experian in driving growth, particularly in

relation to product development. Research expenditure

totalled $5m during the year to 31 March 2007 (and the

amount charged to the Group income statement in the

year was $5m).

Profit and dividends

The Group income statement on page 60 shows a profit

for the financial year to 31 March 2007 of $463m. The

directors have announced the payment of a second

interim dividend of 11.5 US cents per ordinary share to be

paid on 27 July 2007 to shareholders on the register on

29 June 2007. An interim dividend of 5.5 US cents per

ordinary share was paid on 2 February 2007 giving a total

dividend for the year of 17.0 US cents per ordinary share.

Directors

The names and biographical details of the directors are

shown on pages 38 and 39. Particulars of directors’

remuneration, service contracts and their interests in the

Ordinaryshares of the Company are shown in the report

on directors’ remuneration on pages 47 to 58. There were

no changes in the directors’ interests in the Company’s

Ordinaryshares between the end of the financial year

and 22 May 2007.

Geoffrey Moore and Stephen Ranalow, the directors on

incorporation of the Company on 30 June 2006, resigned

on 6 July 2006. John Peace, Paul Brooks, Don Robert and

David Tyler wereappointed directors on 6 July 2006 and

Sir Alan Rudge was appointed on 6 September 2006.

Fabiola Arredondo, Laurence Danon, Roger Davis and

Alan Jebson joined the Board on 1 January 2007. Sean

FitzPatrick was appointed to the Board with effect from

1April 2007.

In accordance with the Company’s Articles of Association,

all the directors retire at this year’s Annual General

Meeting, being the first annual general meeting after their

appointment. Each of them, being eligible, offer

themselves for election. The Board proposes to carry out

the first formal evaluation of its performance, its

committees and its members during the year ending 31

March 2008. In the meantime the Board is satisfied that

the performance, contribution and commitment of the

directors is such that they merit election. Any director who

is so elected will retire at least every three years and

unless he or she has agreed to retire, he or she shall be

eligible for re-election.

During the year,the Company maintained liability

insurance and third party indemnification provisions for its

directors and officers.

Acquisitions

The Group made a number of acquisitions in the year

under review,details of which areincluded in note 30 to

the financial statements on page 110.

On 19 April 2007 the Company announced its intention,

subject to regulatoryapproval, to acquire Hitwise, a

leading internet marketing intelligence company for

$240m. The Company announced the acquisitions of

Emailing Solution, a leading French permission-based

email marketing company, and the Tallyman collections

management software business from Talgentra, a

softwaresolutions company,on 3 May 2007 and 11 May

2007 respectively.

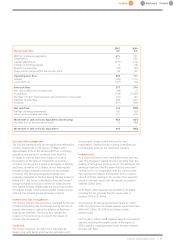

Substantial shareholdings

As at 22 May 2007, the Company had been notified of

the following interests in its issued ordinary share capital

or voting rights:

40 |Experian Annual Report 2007

Introduction | Business review | Governance |Financial statements

Directors’ report

Percentage of

Direct/ Number of issued share

Date of indirect ordinary shares/ capital/voting

Notification Shareholder interest (i) voting rights (i) rights (i)

5February2007 Legal and General Direct 51,238,042 5.01%

Group plc

(i) Until 20 January 2007, substantial shareholders were required to notify their interests in

accordance with the Company’s Articles of Association and, thereafter, following

implementation of the EU Transparency Directive effected by the Financial Services

Authority’s Disclosure and Transparency Rules, also their voting rights in accordance with

those rules.

Save for the above, no person has notified any interest of

3per cent or moreor any non-material interest equal to

or more than 10 per cent of the issued ordinary share

capital or in the voting rights of the Company.