Experian 2007 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2007 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

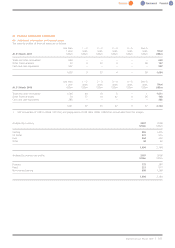

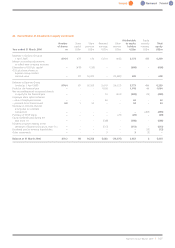

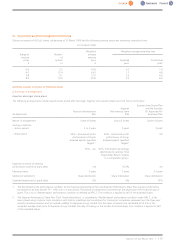

30. Acquisitions and demerger of Home Retail Group (continued)

(b) Demerger of Home Retail Group

As indicated in note 2, the distribution of shares in Home Retail Group plc to shareholders in GUS plc at the date of demerger has been accounted

for as a dividend in specie. This represents the Group’s share of the net assets of Home Retail Group at the date of demerger which comprised:

US$m

Intangible assets 3,716

Property, plant and equipment 1,299

Deferred tax assets 211

Retirement benefit assets 41

Inventories 1,765

Trade and other receivables 1,036

Cash and cash equivalents 518

Trade and other payables (2,156)

Current tax payable (72)

Loans and borrowings (435)

Deferred tax liabilities (122)

Provisions (174)

Group’s share of net assets of Home Retail Group on demerger 5,627

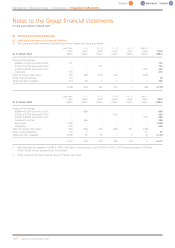

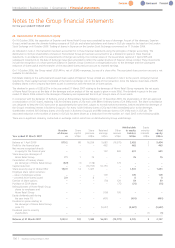

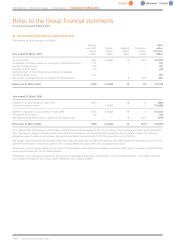

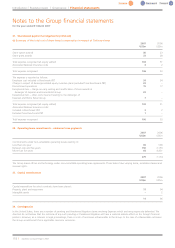

31. Share-based payment arrangements

Prior to the demerger,Experian employees participated in share-based incentive plans in respect of the Ordinaryshares in GUS plc. On demerger,

certain GUS awards vested early and Experian incurred an exceptional charge of US$15m on the acceleration of these awards.

On demerger, the majority of Experian participants’ outstanding GUS share and option awards rolled-over into Experian equivalent awards. A limited

number of share and share option awards remained as GUS awards and participants had entitlement to one Home Retail Group share and one

Experian sharein lieu of each GUS shareallocated. Experian rolled-over awards areshare-based incentive plans in respect of the Ordinary shares in

Experian Group Limited. The quantity and exercise price of grants were modified to adjust for the difference between the GUS and Experian share

prices. The roll-over resulted in an incremental change in fair value of US$8m, which was incurred as an exceptional item. The incremental fair value

was primarily as a result of an assumption in respect of the higher volatility of the Experian share price.

Early vesting and modification changes have been recorded as an exceptional item (note 7).

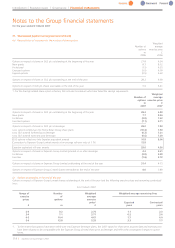

Option and shareprices are disclosed in Sterling reflecting the currency in which the Ordinary shares of GUS plc and Experian Group Limited are

quoted.

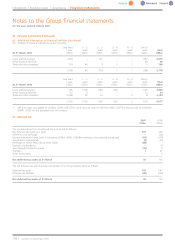

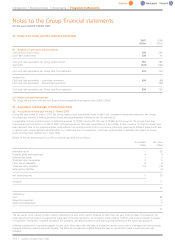

(a) Options in respect of Ordinary shares

(i) Summary of arrangements

Experian demerger plan – Experian Share Option Plan

The Experian Share Option Plan includes awards made at and after demerger together with awards rolled-over from former GUS plans and

arrangements were as follows:

Nature Grant of options

Vesting conditions:

–Service period 3 and 4 years

–Performance/Other n/a

Expected outcome of meeting performance criteria (at grant date) n/a

Maximum term 10 years

Method of settlement Share distribution

Expected departures (at grant date) 5%

Option exercise price calculation1Market price over the 3 dealing days preceding the grant

1. Three day averages arecalculated by taking middle market quotations of an Experian Group Limited share from the London Stock Exchange

daily official list.

Experian Annual Report2007 |111