Experian 2007 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2007 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

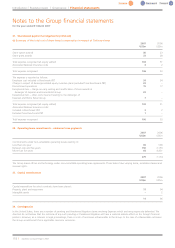

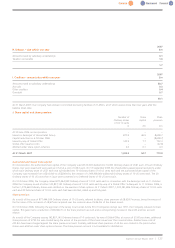

35. Related parties

The ultimate parent company of the Group is Experian Group Limited which is incorporated in Jersey. The principal subsidiary and associate

undertakings at 31 March 2007 are shown in note O to the financial statements of the ultimate parent company.

The following transactions were carried out with related parties of Experian:

Associates

During the year the Group made net sales and recharges, under normal commercial terms and conditions that would be available to third parties, to

First American Real Estate Solutions LLC (‘FARES’) and its associate First Advantage Corporation, of US$29m (2006: US$21m). Amounts receivable

from FARES are shown within note 18. These amounts outstanding are unsecured and will be settled in cash. No guarantees have been given or

received in the year. No provisions have been made for doubtful debts in respect of the amounts owed by related parties.

Subsidiaries

Transactions between the ultimate parent company and its subsidiaries, and between subsidiaries, have been eliminated on consolidation.

Home Retail Group

Under the terms of the demerger agreement entered into in August 2006, the Group has contracted to provide certain services to Home Retail

Group on a transitional basis for a period of not more than two years after the date of the demerger. The fees payable for these services are

determined on an arm’s length basis. Since the demerger, the Group has charged US$0.3m to Home Retail Group in respect of these services.

Since the date of demerger Experian has made sales of US$10m to Home Retail Group companies on normal commercial terms.

Key management personnel

Remuneration of key management personnel is disclosed in note 6(c). During the year therewereno material transactions or balances between the

Group and its key management personnel or members of their close families.

Other related parties

Therewereno other material related party transactions. Services areusually negotiated with related parties on a cost-plus basis. Goods arebought

on the basis of the price lists in force with non-related parties.

Experian Annual Report2007 |119