Experian 2007 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2007 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

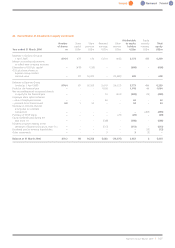

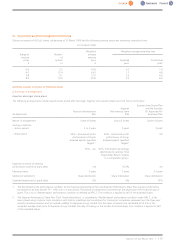

31. Share-based payment arrangements (continued)

Number of

options

m

2007

Share awards in respect of shares in GUS plc outstanding at the beginning of the year 5.0

New grants 2.8

Vesting (4.2)

Awards in respect of shares in GUS plc at demerger 3.6

Less awards rolled-over into Home Retail Group share plans (0.7)

GUS share awards to Experian participants at demerger 2.9

Conversion to Experian Group awards at an average roll-over ratio of 1.78 2.3

Experian equivalent roll-over awards 5.2

Share awards in respect of Experian Group Limited on or after demerger 19.8

Forfeitures (0.4)

Share awards in Experian Group Limited outstanding at the end of the year 24.6

For Experian demerger plans there were 19,022,982 shares granted in 2007, with a weighted average award fair value of £5.20. For former GUS

plans there were 2,814,465 shares granted in 2007 (2006: 2,635,145), with a weighted average award fair value of £6.74 (2006: £7.69).

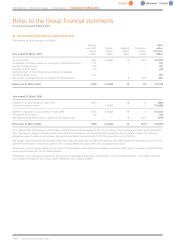

(c) Modification of GUS awards to Experian participants

(i) Details of modification

Prior to demerger,Experian participants held share incentive grants with entitlement to GUS share distributions. On demerger, the majority of

outstanding awards were rolled-over into plans with entitlement to Experian Group Limited share distributions. The quantity and exercise price of

awards were modified to maintain an equivalent compensation as the original GUS grants. The incremental fair value of the modification was US$8m.

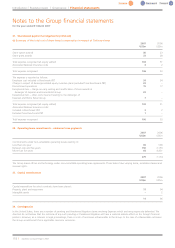

(ii) Information relating to modified options

In total, 16.9m GUS options were rolled-over into 30.0m Experian Group Limited options. A Black-Scholes model was used to determine the fair

value of GUS and Experian Group Limited awards for modified grants. The weighted average estimated fair values and the inputs into the Black-

Scholes model areas follows:

Weighted average

GUS Experian

awards awards

Fair value (£) 2.71 1.64

Shareprice on modification date (£) 9.90 5.62

Exercise price (£) 8.08 4.57

Expected volatility 25.6% 27.6%

Expected dividend yield 3.7% 3.7%

Risk-free rate 4.9% 4.9%

Expected option life to exercise 3.48 years 3.48 years

(iii) Information relating to modified share awards

Weighted average

GUS Experian

awards awards

Quantity modified (millions) 4.9 8.7

Weighted average fair value (£) 8.14 4.67

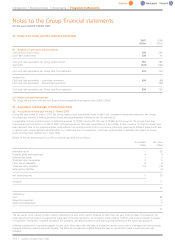

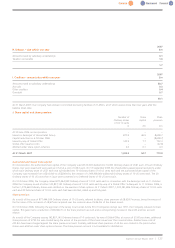

(d) Other share awards

During the year Experian Group Limited issued put options to a small number of employees who own an equity interest in a subsidiary. These

options vest on 31 March 2008 assuming the employees remain with the Group and they will be exercisable from that date onwards. These options

are accounted for under IFRS 2 as performance conditions are linked to employment with the subsidiary. The options will be exercisable at a value

based on 20% of the prevailing market value of the subsidiary for which these employees work and this value is capped at US$50m. The option will

be settled in Experian Group Limited shares. The expected number of shares is 122,000. The option was purchased for US$0.7m by the employees

at fair value as calculated by third party valuation specialists. This valuation is based on the forecast revenue model of the subsidiary. No cost will

arise over the vesting period as the purchase price of the option was its market value.

Experian Annual Report2007 |117