Experian 2007 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2007 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Introduction | Business review | Governance | Financial statements

Total profit

Profit and loss

ESOP and loss account

shares account reserve

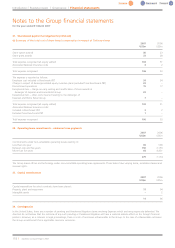

K. Reserves £m £m £m

Loss for the financial period –(4.2) (4.2)

Transfer to profit and loss account on reduction in share capital – 8,628.7 8,628.7

Equity dividends paid during the period –(20.4) (20.4)

Dividend in specie relating to the demerger of Home Retail Group – (3,497.5) (3,497.5)

Transfer of ESOP shares at fair value (80.1) 17.0 (63.1)

Purchase of ESOP shares (33.6) – (33.6)

Allotment of share options 27.7 – 27.7

Credit in respect of share incentive schemes – 23.6 23.6

At 31 March 2007 (86.0) 5,147.2 5,061.2

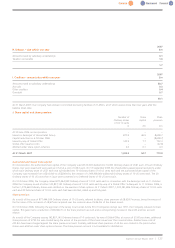

ESOP shares represent the cost of shares in the Company held by the following trusts to satisfy the Group’s obligations under its share incentive plans:

Number of

shares

Experian Group Limited Employee Share Trust 13,419,683

GUS plc ESOP Trust 2,340,100

Experian UK Approved All-Employee Share Plan 926,565

16,686,348

Atotal of 6,670,514 Ordinary shares were purchased by the Trusts from the date of incorporation to 31 March 2007 at a cost of £33.6m. A total of

15,090,260 shares weretransferred from GUS plc to Experian Group Limited on novation of GUS plc’s interest in the GUS plc ESOP Trust for a fair

value of £63.1m. Subsequently a number of these shares have been transferred into the Experian Group Limited Exployee Share Trust.

Equity dividends of £20.4m were paid to those Experian Group Limited shareholders who did not elect to receive dividends under the Income

Access Share (’IAS’) arrangements. In total £28.5m of dividends were paid in the post demerger period of which £8.1m was paid by Experian

Finance plc (formerly GUS plc) under the IAS arrangements.

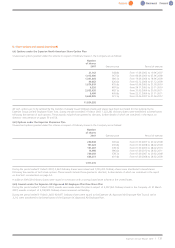

L. Commitments

(i) Capital commitments

There are no significant capital commitments relating to the Company.

(ii) Operating lease commitments

The Company has an annual commitment of £0.3m in respect of the lease of the Group’s Corporate Headquarters in Ireland, this commitment

expires in more than five years. Rental payments commence in May 2008.

M. Contingencies

At 31 March 2007, the Company is the guarantor of the retirement benefit obligations of the Group companies that participate in the Experian

Pension Scheme.

128 |Experian Annual Report2007

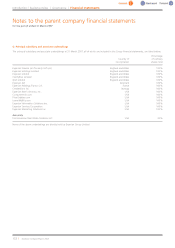

Notes to the parent company financial statements

for the period ended 31 March 2007