Experian 2007 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2007 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138

|

|

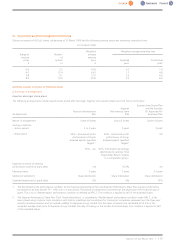

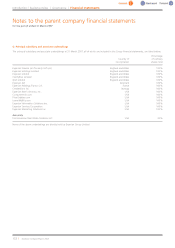

D. Net interest income 2007

£m

Interest income:

External interest income 0.3

Interest on amounts owed by subsidiary undertakings 8.0

Unwind of discount on amount owed by subsidiary undertaking 0.7

9.0

Interest expense:

Interest on amounts owed to subsidiary undertakings (0.3)

Net interest 8.7

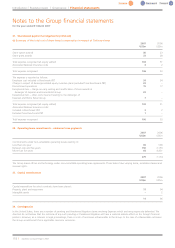

E. Tax on loss on ordinary activities

(i) Tax charge for the period

There was no tax charge for the period. The applicable rate of Corporation tax in Ireland is 25% for investment income (12.5% for trading income).

The differences are explained below:

2007

£m

Loss on ordinary activities before taxation (4.2)

Loss on ordinary activities before tax multiplied by the applicable rate of Corporation tax in Ireland of 25% (12.5% for trading income) (1.1)

Effects of:

Income not taxable (0.1)

Expenses not deductible 1.2

Current tax charge for the period –

(ii) Factors that may affect future tax charges

In the forseeable future, the Company’s tax charge will continue to be influenced by the nature of its income and expenditure in subsequent

accounting periods, and could be affected by changes in tax law.

(iii) Tax effect of exceptional items

The exceptional items included within the Company’sexpenses arenot deductible for tax purposes.

Experian Annual Report2007 |125