Experian 2007 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2007 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Introduction | Business review | Governance | Financial statements

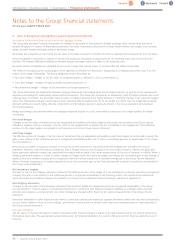

2. Basis of preparation and significant accounting policies (continued)

Accounting for derivative financial instruments and hedging activities

The Group uses derivative financial instruments to manage its exposures to fluctuations in foreign exchange rates, interest rates and social

security obligations in respect of share-based payments. Derivative instruments utilised by the Group include interest rate swaps, cross currency

swaps, forward foreign exchange contracts and equity swaps.

Derivatives are recognised at cost, being the fair value at the date a contract is entered into and are subsequently remeasured at their fair value.

Amounts payable or receivable in respect of interest rate swaps are recognised as adjustments to net financing costs over the period of the

contract. The interest differential reflected in forward foreign exchange contracts is taken to net financing costs.

Derivative assets and liabilities are classified as non-current unless they mature within 12 months after the balance sheet date.

The method of recognising the resulting gain or loss depends on whether the derivative is designated as a hedging instrument, and, if so, the

nature of the hedge relationship. The Group designates certain derivatives as:

•Fair value hedges – hedges of the fair value of recognised assets or liabilities or a firm commitment; or

•Cash flow hedges – hedges of highly probable forecast transactions; or

•Net investment hedges – hedges of net investments in foreign operations.

The Group documents the relationship between hedging instruments and hedged items at the hedge inception, as well as its risk management

objective and strategy for undertaking various hedge transactions. The Group also documents its assessment, both at hedge inception and on an

ongoing basis, of whether the derivatives that are used in hedging transactions are highly effective in offsetting changes in fair values of hedged

items. This effectiveness testing is performed at every reporting date throughout the life of the hedge to confirm that the hedge has remained

and will continue to remain highly effective. Movements on the hedging reserve in equity areshown in the Group statement of recognised

income and expense.

Hedge accounting is discontinued when the hedging instrument expires or is sold, terminated or exercised or no longer qualifies for hedge

accounting.

Fair value hedges

Changes in the fair value of derivatives that aredesignated and qualify as fair value hedging instruments arerecorded in the Group income

statement, together with any changes in the fair value of the hedged asset or liability that areattributable to the hedged risk. The ineffective

portion of a fair value hedge is recognised in net financing costs in the Group income statement.

Cash flow hedges

The effective portion of changes in the fair value of derivatives that are designated and qualify as cash flow hedges are recognised in equity. The

gain or loss relating to the ineffective portion is recognised immediately within cost of sales or operating expenses, as appropriate, in the Group

income statement.

Amounts accumulated in equity are recycled in the Group income statement in the period when the hedged item will affect the income

statement. However,when the forecast transaction that is hedged results in the recognition of a non-financial asset or liability, the gains and

losses previously deferred in equity are transferred from equity and included in the initial measurement of the cost of the asset or liability. When a

hedging instrument expires or is sold, or when a hedge no longer meets the criteria for hedge accounting, any cumulative gain or loss existing in

equity at that time remains in equity and is recognised when the forecast transaction is ultimately recognised in the Group income statement.

When a forecast transaction is no longer expected to occur, the cumulative gain or loss that was reported in equity is transferred immediately to

the Group income statement.

Net investment hedges

Any gain or loss on the hedging instrument relating to the effective portion of the hedge of a net investment in a foreign operation is recognised

in equity; the gain or loss relating to the ineffective portion is recognised immediately in net financing costs in the Group income statement.

Gains and losses accumulated in equity areincluded in the Group income statement when the foreign operation is disposed of.

Non-hedging derivatives

Changes in the fair value of any derivative instrument that does not qualify for hedge accounting are recognised immediately in the Group

income statement. Costs in respect of derivatives entered into in connection with National Insurance liabilities on employee shareincentive

schemes arecharged as an employment cost; other changes are charged within financing fair value remeasurements in the Group income

statement.

Derivatives embedded in other financial instruments or other host contracts are treated as separate derivatives when their risks and characteristics

arenot closely related to those of host contracts, and the host contracts arenot carried at fair value with unrealised gains or losses reported in

the Group income statement.

Fair value estimation

The fair value of financial instruments traded in organised active financial markets is based on quoted market prices at the close of business on

the balance sheet date. The appropriate quoted market price for financial liabilities is the current offer price and for financial assets the current

bid price.

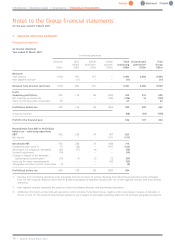

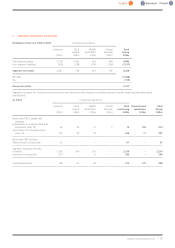

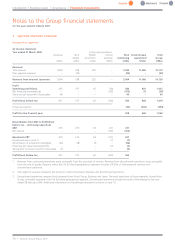

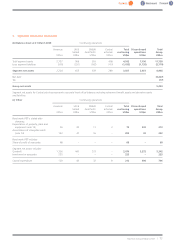

Notes to the Group financial statements

for the year ended 31 March 2007

68 |Experian Annual Report2007