Experian 2007 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2007 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Experian Annual Report 2007 |33

Use of non-GAAP measures

Experian has identified certain measures that it believes

provide additional useful information on the performance

of the Group. As the measures are not defined under

IFRS they may not be directly comparable with other

companies‘ adjusted measures. The non-GAAP measures

are not intended to be a substitute for, or superior to,

any IFRS measures of performance. Certain non-GAAP

measures identified by the Group are shown in note 2 to

the financial statements. Further non-GAAP measures

and reconciliations of those measures are set out below.

Discontinuing activities: Experian defines discontinuing

activities as businesses sold, closed or identified for

closure during a financial year. These are treated as

discontinuing activities for both sales and EBIT purposes.

Prior periods, where shown, are restated to exclude the

results on discontinuing activities. This financial measure

differs from the definition of discontinued operations set

out in IFRS 5 ‘Non-current assets held for sale and

discontinued operations’. Under IFRS 5, a discontinued

operation is: (i) a separate major line of business or

geographical area of operations; (ii) part of a single plan

to dispose of a major line of business or geographical

area of operations; or (iii) a subsidiary acquired exclusively

with a view to resale.

Continuing activities: Businesses trading at 31 March

2007 that have not been disclosed as discontinuing

activities are treated as continuing activities.

Organic growth: This is the year-on-year change in

continuing activities sales, at constant exchange rates,

excluding acquisitions (other than affiliate credit bureaux)

until the first anniversary date of consolidation.

Direct business: Direct business refers to Experian’s

business exclusive of financial results of FARES.

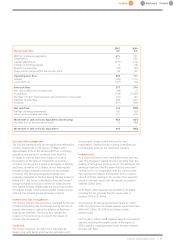

Reconciliation of sales and EBIT by geography

12 months to 31 March 2007 2006

Continuing Discontinuing Total Continuing Discontinuing Total

activities activities activities activities

$m $m $m $m $m $m

Sales

Americas 1,990 4 1,994 1,731 73 1,804

UK & Ireland 843 64 907 677 81 758

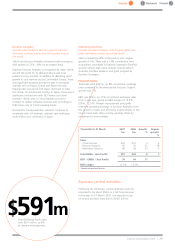

EMEA/Asia Pacific 591 - 591 522 - 522

Total sales 3,424 68 3,492 2,930 154 3,084

EBIT

Americas – direct business 508 (7) 501 404 6 410

FARES 61 - 61 69 - 69

Total Americas 569 (7) 562 473 6 479

UK & Ireland 221 24 245 179 36 215

UK & Ireland restructuring charge (8) - (8) - - -

EMEA/Asia Pacific 74 - 74 64 - 64

Central activities (47) - (47) (31) - (31)

Total EBIT 808 17 825 685 42 727

Net interest (111) (100)

Benchmark PBT 714 627

Exceptional items (162) (7)

Amortisation of acquisition intangibles (76) (66)

Goodwill adjustment (14) -

Charges for demerger-related equity incentive plans (24) -

Financing fair value remeasurements (35) (2)

Tax expense of associates (9) (2)

Profit before tax 394 550