Experian 2007 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2007 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

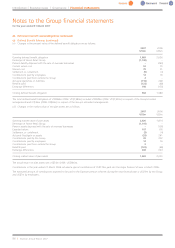

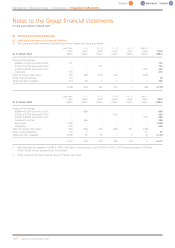

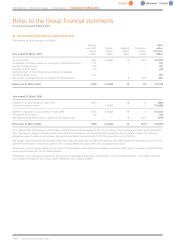

27. Deferred tax (continued)

The movement in gross deferred tax assets and liabilities during the year, without taking into consideration the offsetting of balances within the

same tax jurisdiction, is as follows:

(a) Deferred tax assets

Share option Other

Accelerated and award Asset temporary

depreciation Intangibles schemes provisions Tax losses differences Total

US$m US$m US$m US$m US$m US$m US$m

At 1 April 2006 6 164 42 90 33 212 547

Differences on exchange – – 4 9 1 12 26

Income statement charge (1) (36) (6) 8 (31) 24 (42)

Acquisition of subsidiaries – – – – 5 – 5

Demerger of Home Retail Group (note 30(b)) (2) – (17) (79) – (113) (211)

Transfers – – – – – (24) (24)

Tax credited/(charged) to equity – – (3) – – 6 3

Other movements – – – (2) – 2 –

At 31 March 2007 3 128 20 26 8 119 304

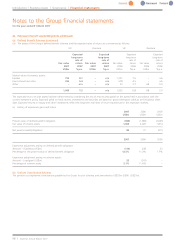

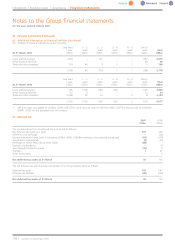

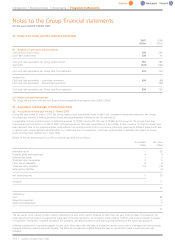

(b) Deferred tax liabilities

Share option Other

Property Accelerated and award Asset temporary

valuations depreciation Intangibles schemes provisions Tax losses differences Total

US$m US$m US$m US$m US$m US$m US$m US$m

At 1 April 2006 52 64 62 1 – 6 165 350

Differences on exchange 5 4 8 – – 1 8 26

Income statement charge – 2 (6) – – (2) 18 12

Acquisition of subsidiaries ––7––––7

Demerger of Home Retail Group

(note 30(b)) (52) (36) (1) – – – (33) (122)

Transfers – – – – – – (25) (25)

Tax charged to equity ––––––2121

At 31 March 2007 5 34 70 1 – 5 154 269

Deferred tax assets are recognised for tax loss carry-forwards and other temporary differences to the extent that the realisation of the related tax

benefit through futuretaxable profits is probable.

The Group did not recognise deferred tax assets of US$19m (2006: US$9m including US$3m relating to discontinued operations) in respect of losses

that can be carried forward against future taxable income. In addition the Group did not recognise deferred tax assets of US$22m (2006: US$78m

including US$55m relating to discontinued operations) in respect of capital losses that can be carried forward against future taxable gains. These

losses areavailable indefinitely.

Deferred tax liabilities of US$2,187m (2006: US$2,034m including US$10m relating to discontinued operations) have not been recognised for the

withholding tax and other taxes that would be payable on the unremitted earnings of certain subsidiaries. As the earnings are continually reinvested

by the Group, no tax is expected to be payable on them in the foreseeable future.

At the balance sheet date there were deferred tax assets recoverable within the next twelve months of US$120m (2006: US$110m) and deferred

tax liabilities payable within the next twelve months of US$10m (2006: US$7m).

Experian Annual Report2007 |105