Experian 2007 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2007 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Experian Annual Report 2007 |57

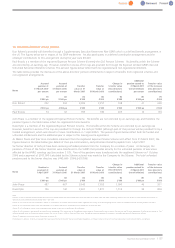

10. Executive directors’ annual pension

Don Robert is provided with benefits through a Supplementary Executive Retirement Plan (SERP) which is a defined benefit arrangement in

the US. The figures below are in respect of his SERP entitlement. He also participates in a defined contribution arrangement and the

employer contributions to this arrangement during the year were $9,423.

Paul Brooks is a member of the registered Experian Pension Scheme (formerly the GUS Pension Scheme). His benefits within the Scheme

are restricted by an earnings cap. However, benefits in excess of this cap are provided for through the Experian Limited SURBS (Secured

Unfunded Retirement Benefits Scheme). The pension figures below reflect both his registered and non-registered entitlement.

The table below provides the disclosure of the above directors’ pension entitlements in respect of benefits from registered schemes and

non-registered arrangements.

Don Robert 252 204 4,006 3,257 748 41 649

£’000 pa £'000 pa £'000 £'000 £’000 £'000 pa £’000

Paul Brooks 74 62 995 784 203 10 130

John Peace is a member of the registered Experian Pension Scheme. His benefits are not restricted by an earnings cap, and therefore the

pension figures in the table below reflect his registered Scheme benefits.

David Tyler is a member of the registered Experian Pension Scheme. His benefits within the Scheme are restricted by an earnings cap.

However,benefits in excess of this cap areprovided for through the GUS plc SURBS (although part of this promise will be provided for by a

funded arrangement, which was closed to futurecontributions on 1 April 2002). The pension figures below reflect both his funded and

unfunded entitlements and the additional year in respect of his leaving service agreement.

As Messrs Peace and Tyler took immediate retirement from the registered Experian Pension Scheme with effect from 31 March 2007, the

figures shown in the table below give details of their pre-commutation, early retirement benefits payable from 1 April 2007.

Six former directors of GUS plc have been receiving unfunded pensions from the Company for a number of years. At demerger, the

pensions of three of the former directors were transferred to the SURBS that provides security for the unfunded pensions of executives

affected by the HMRC earnings cap (see section 2.1(f)). Two of the pensions were transferred into the registered Scheme on 1 October

2006 and a payment of £107,900 (calculated by the Scheme actuary) was made by the Company to the Scheme. The total unfunded

pensions paid to the former directors was £445,646 (2006:£429,596).

John Peace 487 467 9,645 7,655 1,990 46 911

David Tyler 156 142 3,401 1,871 1,514 39 834

Notes:

Columns (1) and (2) represent the deferred pension to which the director would have been entitled had they left the Group at 31 March 2007 and 2006, respectively, except in the cases of Messrs Peace and Tyler where column (1)

represents the early retirement pension payable from 1 April 2007.

Column (3) is the transfer value of the pension in column (1) calculated as at 31 March 2007 based on factors supplied by the actuary of the relevant group pension scheme in accordance with UK actuarial guidance note GN11.

Column (4) is the equivalent transfer value, but calculated as at 31 March 2006 on the assumption that the director left service at that date.

Column (5) is the change in transfer value of accrued pension during the year net of contributions by the director.

Column (6) is the increase in pension built up during the year, recognising (i) the accrual rate for the additional service based on the pensionable salary in force at the year end, and (ii) where appropriate the effect of pay changes in “real”

(inflation adjusted) terms on the pension already earned at the start of the year. In Messrs Peace and Tyler’s cases, the additional pension represents the increase in immediate pension with allowance for inflation.

Column (7) represents the transfer value of the pension in column (6).

The disclosures in columns (1) to (5) are equivalent to those required by the UK Directors’ Remuneration Report Regulations and those in columns (6) and (7) are those required by the UK Listing Authority’s Listing Rules.

Pension in

payment at

1April 2007

(1)

£’000 pa

Accrued

pension at

31 March 2006

(2)

£'000 pa

Transfer

value at

31 March 2007

(3)

£'000

Transfer

value at

31 March 2006

(4)

£'000

Change in

transfer value

(less director’s

contributions)

(5)

£’000

Additional

pension accrued to

31 March 2007

(net of inflation)

(6)

£'000 pa

Transfer value

of the increase

(less director’s

contributions)

(7)

£’000

Accrued

pension at

31 March 2007

per annum

(1)

$’000 pa

Accrued

pension at

31 March 2006

per annum

(2)

$'000 pa

Transfer

value at 31

March 2007

(3)

$'000

Transfer

value at

31 March 2006

(4)

$'000

Change in

transfer value

(less director’s

contributions)

(5)

$’000

Additional

pension earned to

31 March 2007

(net of inflation)

per annum

(6)

$'000 pa

Transfer value

of the increase

(less director’s

contributions)

(7)

$’000

Name

Name