Experian 2007 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2007 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52 |Experian Annual Report 2007

Introduction | Business review | Governance |Financial statements

Report on directors’ remuneration cont.

Notes:

1. Non-executive directors receive an additional fee of €5,981 per trip to attend Board Meetings where such attendance involves inter-continental travel from their home location. For the period under review Fabiola Arredondo did not

receive this allowance as her travel to the Board Meeting did not include such travel.

2. Benefits to executive directors include private health care, company car and fuel allowance where applicable.

3. John Peace was appointed Chairman of Experian Group Limited on 6 July 2006. Until 11 December 2006, he was also Group Chief Executive of GUS plc. The figures in this table represent his salary, benefits and director’s fees for

the whole of the financial year and were paid by Experian Finance plc (formerly GUS plc), his employer in respect of his employment in this period. He did not receive a separate fee as Chairman of Experian Group Limited for the

year ending 31 March 2007. During the year under review, John Peace served as non-executive Chairman of Burberry Group plc. He did not receive any additional remuneration for these services. With effect from 1 April 2007,

Experian Group Limited will pay his director’s fees. From this date his fee is £450,000 per annum. From 1 April 2007 he is not eligible for a performance bonus, pension contributions or further long term incentive awards but will

continue to receive a company car benefit and coverage under the Company’s private healthcare arrangements.

4. Don Robert and Paul Brooks were appointed to the Board of Experian Group Limited on 6 July 2006. Don Robert remains a Director of Experian Finance plc. The figures in the table represent sums paid for the whole of the financial

year. These sums were paid by their respective employers. Experian Group Limited pays directors’ fees of €106,154 per annum (and pro rata for the year ending 31 March 2007) in respect of their services as directors of Experian

Group Limited. Such fees form part of, and are not additional to, the remuneration set out in the table. During the year under review, Don Robert served as a non-executive director of First Advantage Corporation for which he

received a fee of US$51,000. Benefit payments to Paul Brooks include payments for housing whilst he was on expatriate assignment in the US.

5. Fabiola Arredondo, Laurence Danon, Roger Davis and Alan Jebson were appointed to the Board of Experian Group Limited on 1 January 2007. The figures in the table represent their fees and expenses from this date. As is

permissible under Jersey law, the Company has met the cost of the tax payment on their taxable travel expenses where applicable.

6. Sir Alan Rudge was appointed as the Senior Independent Director on 6 September 2006. Prior to this he was a non-executive director of GUS plc until 11 October 2006. The figures in this table represent his fees and expenses for

the whole of the financial year.As is permissible under Jersey law,the Company has met the cost of the tax payment on his taxable travel expenses where applicable.

7. David Tyler was appointed to the Board of Experian Group Limited on 6 July 2006. Until 31 March 2007, he was Group Finance Director of GUS plc. The figures in this table represent his salary, benefits and director’s fees for the

whole of the financial year and were paid by Experian Finance plc (formerly GUS plc), his employer in respect of his employment in this period. He did not receive a separate fee as a director of Experian Group Limited for the year

ending 31 March 2007. During the year under review, David Tyler served as non-executive director of Burberry Group plc. He did not receive any additional remuneration for these services. With effect from 1 April 2007, David

ceased to be an executive director of GUS plc (now Experian Finance plc) by reason of redundancy; his contract provides for a notice period of 12 months or contractual pay in lieu of notice for 12 months. Contractual pay on

redundancy includes base salary (£545,000), car and fuel allowance (£18,200). These payments were made in April 2007. From 1 April 2007, Experian Group Limited will pay his non-executive director’s fee. This fee is €106,154.

From 1 April 2007 he is not be eligible for a performance bonus, pension contributions or further long termincentive awards.

8. Sir Victor Blank resigned as Chairman of GUS plc on 11 December 2006. John Coombe, Andy Hornby, Frank Newman and Oliver Stocken resigned as directors of GUS plc on 11 October 2006. The figures in this table represent

their fees up to this date.

Transition arrangements on demerger of GUS plc

The Chairman, the executive directors and one of the non-executive directors have existing long-term incentive plan awards previously

approved and issued by GUS plc. These existing long-termincentive plan awards include share options as described in section 6, awards

under the GUS Performance Share Plan as described in section 8 and awards under the GUS Co-investment Plan and Experian

Reinvestment Plan as described in section 9.

Each of these long-termincentive plan awards was subject to transitional arrangements on demerger of GUS plc. Each award under the GUS

plans has been adjusted to an equivalent number of Experian awards based on the GUS plc and Experian Group Limited share price at demerger.

Similarly,the share option exercise price of existing GUS awards has been adjusted to the equivalent exercise price for each Experian share.

Sections 6, 8 and 9 of the report on directors’ remuneration detail the opening GUS awards at 1 April 2006 and the changes to the

original GUS awards on demerger.

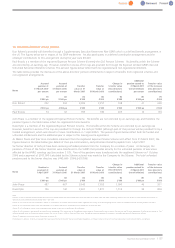

5. Annual remuneration

The following table shows an analysis of the emoluments of the individual directors for the full year ended 31 March 2007.

Salary and Annual Total Total

Fees(1) bonus Benefits(2) 2007 2006

‘000s ‘000s ‘000s ‘000s ‘000s

Chairman

John Peace (3) £875 £875 £34 £1,784 £1,181

Executive directors

Don Robert (4) $1,300 $937 $104 $2,341 $2,393

Paul Brooks (4) $596 $532 $242 $1,370 $1,068

Non-executive directors

Fabiola Arredondo (5) €27 – €1€28 –

Laurence Danon (5) €33 – – €33 –

Roger Davis (5) €39 – – €39 –

Alan Jebson (5) €40 – €1€41 –

Sir Alan Rudge (6) €88 – €1€89 £68

David Tyler (7) £545 £545 £20 £1,110 £735

Former directors

Sir Victor Blank (8) £358 – £31 £389 £197

John Coombe (8) £64 – – £64 £60

Andy Hornby (8) £43 – – £43 £58

Frank Newman (8) £43 – – £43 £58

Oliver Stocken (8) £64 – – £64 £81

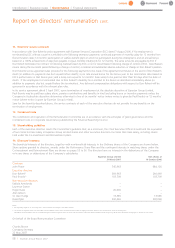

The following shares were purchased for the former non-executive Directors of GUS plc over the two day period 20 and 21 July 2006. The

value reported below is included within the remuneration reported in the above table.

No of Value

shares £

Sir Victor Blank(8) 18,000 179,252

John Coombe(8) 4,000 39,835

Andy Hornby(8) 2,500 24,897

Frank Newman(8) 2,500 24,897

Oliver Stocken(8) 4,000 39,835

The information set out in sections 5 to 10 below has been subject to audit.