Experian 2007 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2007 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Introduction | Business review | Governance | Financial statements

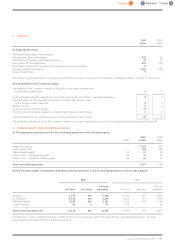

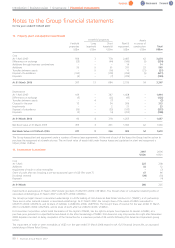

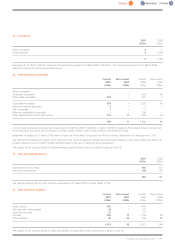

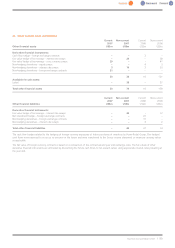

15. Property, plant and equipment (continued)

Leasehold properties Assets

Freehold Long Short Plant & in course of

properties leasehold leasehold equipment construction Total

US$m US$m US$m US$m US$m US$m

Cost

At 1 April 2005 564 3 778 2,467 62 3,874

Differences on exchange (25) – (44) (160) (5) (234)

Additions through business combinations – – – 14 – 14

Additions 55 5 91 331 23 505

Transfers between assets – 5 (16) 11 (21) (21)

Disposal of subsidiaries (193) – (118) (295) (5) (611)

Disposals (4) – (7) (209) – (220)

At 31 March 2006 397 13 684 2,159 54 3,307

Depreciation

At 1 April 2005 109 – 347 1,458 – 1,914

Differences on exchange (5) – (25) (95) – (125)

Transfers between assets – 4 (7) – – (3)

Charge for the year 13 – 34 266 – 313

Impairments ––221–23

Disposal of subsidiaries (55) – (29) (193) – (277)

Disposals (2) – (4) (202) – (208)

At 31 March 2006 60 4 318 1,255 – 1,637

Net Book Value at 31 March 2005 455 3 431 1,009 62 1,960

Net Book Value at 31 March 2006 337 9 366 904 54 1,670

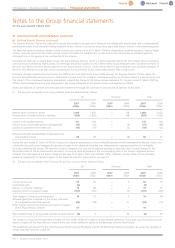

The Group leases plant and equipment under a number of finance lease agreements. At the end of each of the leases the Group has the option to

purchase the equipment at a beneficial price. The net book value of assets held under finance leases and capitalised in plant and equipment is

US$nil (2006: US$7m).

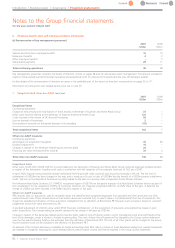

16. Investments in associates 2007 2006

US$m US$m

Cost

At 1 April 225 208

Additions 33 12

Impairment of trade or other receivables –(7)

Shareof profit after tax including a pre-tax exceptional gain of US$15m (note 7) 67 66

Dividends received (39) (50)

Disposals –(4)

At 31 March 286 225

Investments in associates at 31 March 2007 include goodwill of US$219m (2006: US$186m). The Group’s share of cumulative retained profits of

associated undertakings at 31 March 2007 is US$127m (2006: US$99m).

The Group’s principal interest in associated undertakings is a 20% holding of First American Real Estate Solutions LLC (‘FARES’), a US partnership.

There are no other material interests in associated undertakings. At 31 March 2007, the Group’s share of the assets of FARES amounted to

US$477m (2006: US$374m), and its share of liabilities is US$200m (2006: US$155m). The Group’s share of revenue for the year ended 31 March

2007 is US$249m (2006: US$254m), and its share of profit after tax US$67m (2006: US$66m).

First American Corporation, which holds the balance of the capital of FARES, has the right to acquire from Experian its interest in FARES, at a

purchase price pursuant to a specified formula based on the after tax earnings of FARES. First American may only exercise this right after November

2008. Experian can elect to delay completion of the transaction for a maximum period of 24 months following First American Corporation giving

notice.

The impairment of trade or other receivables of US$7m in the year ended 31 March 2006 related to AA GUS Financial Services NV, an associated

undertaking of Home Retail Group.

Notes to the Group financial statements

for the year ended 31 March 2007

90 |Experian Annual Report2007