Experian 2007 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2007 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial review

30 |Experian Annual Report 2007

Demerger

On 10 October 2006, the separation of Experian Group

Limited and Home Retail Group was completed by way of

demerger. As part of the demerger, Experian Group Limited

became the ultimate holding company of GUS plc. The

demerger transaction has been accounted for in

accordance with the UK GAAP principles of merger

accounting, which are not in conflict with IFRS and reflect

the economic substance of the transaction. The distribution

to GUS plc shareholders of shares in Home Retail Group plc

has been accounted for as a dividend in specie in the

financial statements. In addition the results of Home Retail

Group have been represented as discontinued.

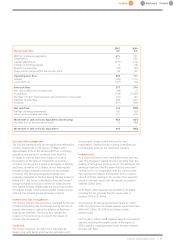

Sales

Group sales from continuing operations grew by 14%

from $3,064m to $3,481m.

Profit

Benchmark profit before tax for continuing operations

rose by $87m to $714m. The increase in benchmark

profit is largely a result of the 14% increase in sales from

continuing operations. Profit before tax from

discontinued operations decreased by 74% to $228m

principally because the prior year includes a full year of

the Home Retail Group results.

Taxation

The Group’s effective rate of tax for the year was 22.4%,

based on benchmark profit. This compares to 17.5%

last year.

Shareholder return and dividends

Following the demerger and equity issue completed in

October, Experian now has approximately 1,022m

Ordinary shares in issue. The number of shares to be

used for the purposes of calculating basic earnings per

share going forward is 1,006m after deducting own

shares held.

Basic earnings per share were 49.9c in the year to

31 March 2007. The basic earnings per share for the

prior year of 107.5c includes 59.1c related to

discontinued operations. Benchmark earnings per share

increased to 59.7c from 54.5c last year. The Board has

announced a dividend of 11.5c, giving a dividend of 17c

for the full year. The dividend for the year is covered 3.5

times from benchmark earnings.

Share price and total shareholder return

On 6 October 2006 shares in GUS plc ceased to be listed

on the London Stock Exchange’s market for listed

securities. Trading in shares in Experian Group Limited on

the London Stock Exchange commenced on 11 October

2006. On that day, Experian Group Limited also raised

£800m by way of a share offer at an offer price of

560p per share.

The share price of Experian ranged from a low of 559.5p

to a high of 631.5p during the period since listing. On

31 March 2007, the mid market price was 585.5p, giving

a market capitalisation of $11.7bn at that date.

Shareholders’ funds

Shareholders’ funds amount to $2,107m, equivalent to

$2.06 per share, a decrease of $3,347m in the year. This

principally reflects the reduction of net assets following

the demerger of Home Retail Group (decrease of

$5,627m) offset by the proceeds of the equity issue

(increase of $1,441m).

Cash flow and net debt

The Group’s free cash flow before acquisitions,

divestments and dividends was $577m compared with

$574m in 2006. Capital expenditure in 2007 was

$275m, $63m higher than last year. Capital expenditure,

which included accelerated spend of $20m on data

centre consolidation, was equivalent to 121% of the

depreciation charge in 2007. Free cash flow was used to

fund acquisitions of $118m, the purchase of other

financial assets and investment in associates of $42m

and dividends of $401m (principally the final dividend

paid by GUS plc). Cash outflow from exceptional items

amounted to $98m. After proceeds from disposals of

businesses of $258m, net cash inflow for the year was

$176m. Net debt at 31 March 2007 decreased by

$2,029m to $1,408m, down from $3,437m at

31 March 2006.

Acquisitions

Acquisition expenditure amounted to $118m, including

deferred and contingent consideration on prior year

acquisitions.

Liquidity and funding

The maturity, currency and interest rate profile of the

Group’s borrowings are shown in note 26 to the financial

statements. The maturity profile is spread over the next

seven years, to avoid excessive concentration of re-

financing needs. At 31 March 2007 undrawn committed

borrowing facilities totalled $2,450m.

Treasury and risk management

The Group’s Treasury function seeks to reduce

exposures to foreign exchange, interest rate and

other financial risks, to ensure sufficient

liquidity is available to meet foreseeable

needs and to invest cash assets safely and

profitably. It does not operate as a profit

centre and transacts only in relation to

underlying business requirements. It

operates policies and procedures which

are periodically reviewed and approved

by the Board and are subject to regular

Group Internal Audit reviews.

Introduction | Business review | Governance | Financial statements

£800

m

At the time of the

demerger, Experian

raised £800 million to

support future

growth initiatives