Experian 2007 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2007 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Experian Annual Report2007 |93

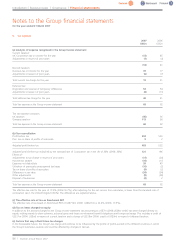

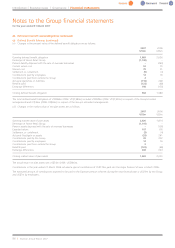

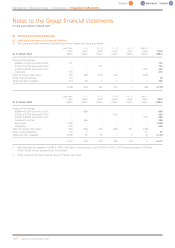

23. Provisions

Home Retail

Restructuring Group

provision provisions Total

US$m US$m US$m

At 1 April 2006 – 155 155

Differences on exchange 21214

Amount charged in the year 37 12 49

Utilised – (7) (7)

Impact of discount rate movement –22

Demerger of Home Retail Group (note 30 (b)) – (174) (174)

At 31 March 2007 39 – 39

Disclosed within Non-current liabilities 30 – 30

Disclosed within Current liabilities 9–9

At 31 March 2007 39 – 39

Home Retail

Group

provisions Total

US$m US$m

At 1 April 2005 167 167

Differences on exchange (14) (14)

Amount charged in the year 24 24

Utilised (24) (24)

Impact of discount rate movement 2 2

At 31 March 2006 155 155

Disclosed within Non-current liabilities – –

Disclosed within Current liabilities 155 155

At 31 March 2006 155 155

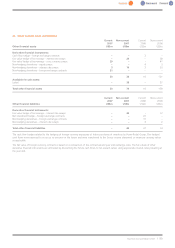

The restructuring provision at 31 March 2007, disclosed within current liabilities, included the full cost of the restructuring cost of UK Marketing

Solutions, which is expected to be utilised in the year ended 31 March 2008. The restructuring provision at 31 March 2007 of US$30m disclosed

within non-current liabilities comprised the anticipated future costs of the withdrawal by Experian from large scale credit card and loan account

processing in the UK, in respect of which there was a charge of US$28m in the year. This provision comprises the estimated costs of redundancy

and certain contractual obligations in respect of this business and has been determined by reference to projections of the timing of withdrawal. It is

anticipated that this portion of the provision will be utilised in the period from 1 April 2008 to 31 March 2010. There was no restructuring provision

at 31 March 2006 and no movements thereon in the year then ended.

Fair values of provisions do not materially differ from the recognised book values.

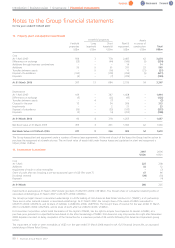

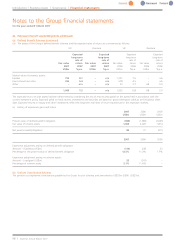

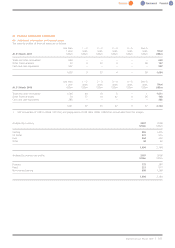

24. Retirement benefit assets/obligations

(a) Defined Benefit Schemes

The Group operates pension plans in a number of countries around the world and provides post-retirement healthcare insurance benefits to certain

former employees.

The Group has both defined benefit and defined contribution plans. A defined benefit plan is a pension plan that defines an amount of pension

benefit that an employee will receive on retirement, usually dependent on one or more factors such as age, years of service and compensation. A

defined contribution plan is a pension plan that defines the amount of contributions that arepaid by the Group into an independently

administered fund.

Pension arrangements for the Group’s UK employees are operated principally through the Experian Pension Scheme (formerly the ‘GUS Pension

Scheme’) which is a defined benefit scheme and the Experian Money Purchase Pension Plan (formerly the ‘GUS Money Purchase Pension Plan’)

which is a defined contribution scheme. In North America, benefits are determined in accordance with local practice and regulations and funding is

provided accordingly. There are no other material pension arrangements.