Experian 2007 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2007 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50 |Experian Annual Report 2007

Introduction | Business review | Governance |Financial statements

Report on directors’ remuneration cont.

This bespoke comparator group consists of Experian’s main competitors in the business areas and countries in which the Group operates.

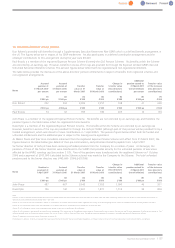

This part of the award will not vest if Experian’s total shareholder return (defined as share price movement plus reinvested dividends) is

below the median return for the comparator group. Once Experian achieves median performance, 25 per cent of this portion of the award

may vest rising on a straight-line basis to 100 per cent of this part of the award vesting for upper quartile performance or better. This can

be summarised as follows:

%of performance shares

subject to the TSR

Experian TSR ranking performance condition

in the peer group that will vest

1st - 6th 100%

7th 85%

8th 70%

9th 55%

10th 40%

11th 25%

12th - 21st 0

The Committee considers that these areappropriate measures as they align the long-term interest of participants with those of

shareholders and provide both internal (PBT) and external (TSR) focus for participants.

(d) Experian Share Option Plan

The Experian Share Option Plan (ESOP) was approved by GUS shareholders at the EGM on 29 August 2006. It is intended to align

shareholder and participant interests through share price growth. Options will vest subject to the satisfaction of a stretching EPS target

which will be set prior to options being granted. No awards will be made to executive directors under the plan until June 2009.

For each of the long term incentive plans, external consultants will be used to calculate whether and the extent to which the performance

conditions have been met.

(e) Experian Sharesave

All executive directors and employees of Experian Group and any participating subsidiaries are eligible to participate in Sharesave if they

have been employed by Experian for a qualifying period. Sharesave provides an opportunity for employees to save a regular monthly

amount which at the end of the savings period may be used to purchase shares under option.

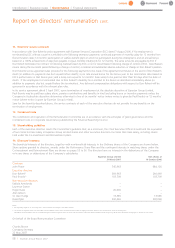

(f) Pensions

Pensions are offered in line with competitive practice. The retirement age for directors is 60 under arrangements which broadly provide a

pension of two thirds of final salary, life assurance and ill health and dependants’ pensions. Incentive payments (such as annual bonuses)

are not pensionable.

The UK Finance Act 2004 made major changes to the taxation and regulation of occupational pension schemes and to the benefits which

occupational pension schemes may provide. The Company has had arrangements in place for a number of years which were designed to

ensure that UK directors who were affected by the 1989 HM Revenue and Customs earnings cap were placed in broadly the same position

as those who were not. With the agreement of the trustees of the scheme, the Company decided to retain a notional earnings cap for its

existing and future employees, with the exception of new senior executives who will be pensioned on full basic salary up to the Lifetime

Allowance.

The Company has put security in place for the unfunded pension entitlements of UK executives affected by the earnings cap, by

establishing Secured Unfunded Retirement Benefits Schemes (SURBS). Further details are provided under the disclosure of the arrangements

for each director.

(g) Service contracts

Each executive director has a rolling service contract which can be terminated by the Company giving twelve months’ notice. In the event

of termination of the director’s contract, any compensation payment is calculated in accordance with normal legal principles, including the

application of mitigation to the extent appropriate in the circumstances of the case.