Experian 2007 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2007 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Experian Annual Report2007 |99

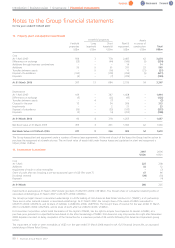

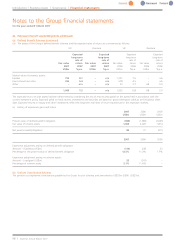

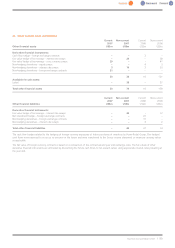

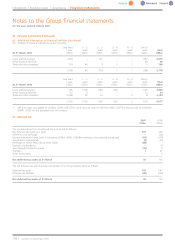

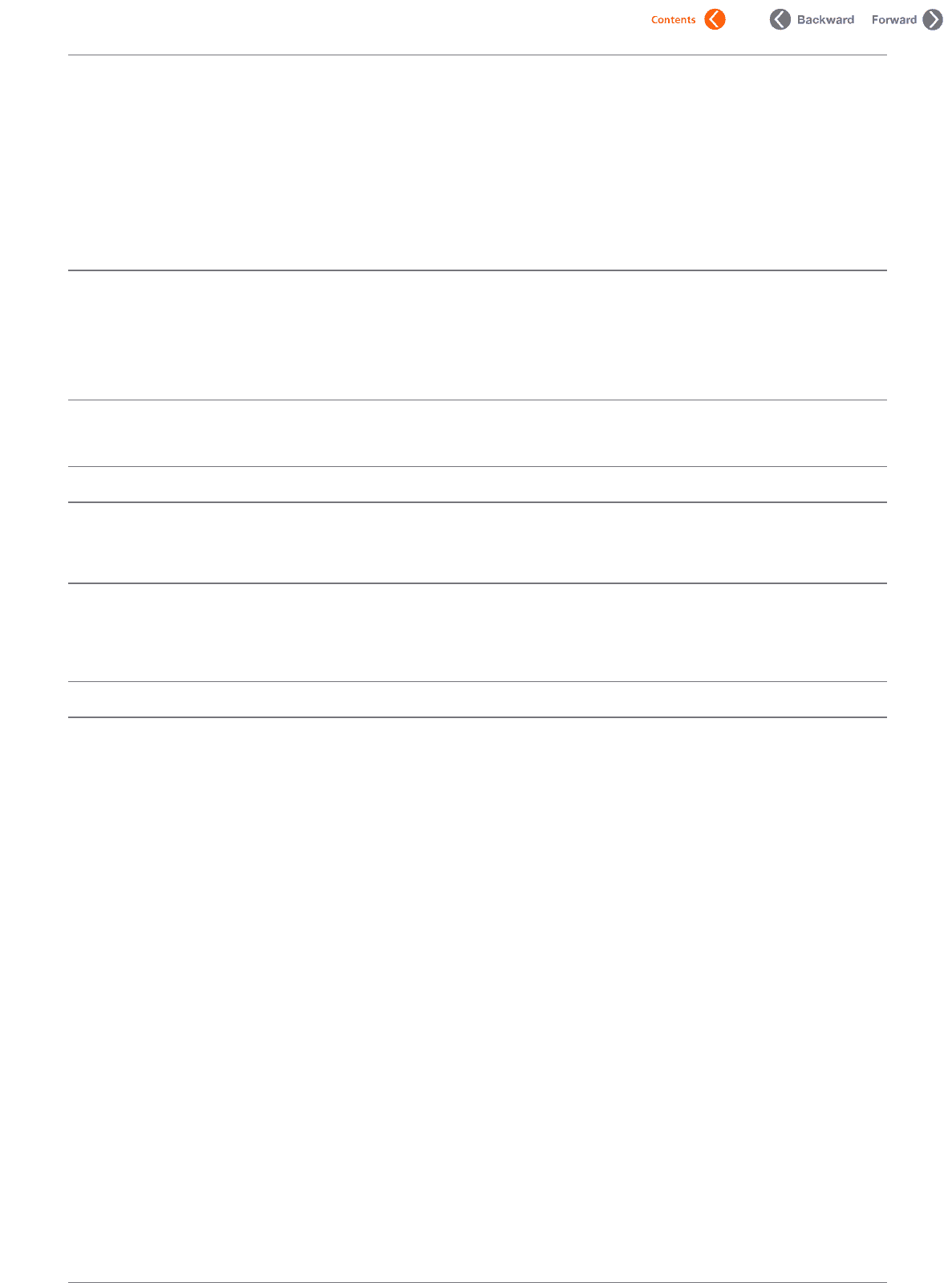

25. Other financial assets and liabilities

Current Non-current Current Non-current

2007 2007 2006 2006

Other financial assets US$m US$m US$m US$m

Derivative financial instruments:

Cash flow hedge – foreign exchange contracts ––3–

Fair value hedge of borrowings – interest rate swaps –20 –38

Fair value hedge of borrowings – cross currency swaps 29 – –47

Non-hedging derivatives – equity swaps ––43

Non-hedging derivatives – interest rate swaps 316 333

Non-hedging derivatives – foreign exchange contracts 21 – ––

53 36 10 121

Available for sale assets:

Listed –38 –37

Total other financial assets 53 74 10 158

Current Non-current Current Non-current

2007 2007 2006 2006

Other financial liabilities US$m US$m US$m US$m

Derivative financial instruments:

Fair value hedge of borrowings – interest rate swaps – 40 – 12

Net investment hedge – foreign exchange contracts ––23 –

Non-hedging derivatives – foreign exchange contracts – – 10 –

Non-hedging derivatives – interest rate swaps ––42

Total other financial liabilities –4037 14

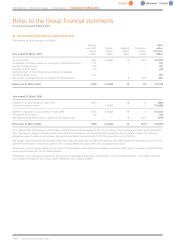

The cash flow hedges related to the hedging of foreign currency exposures of future purchases of inventory by Home Retail Group. The hedged

cash flows were expected to occur up to one year in the future and were transferred to the Group income statement or inventory carrying values

as applicable.

The fair value of foreign currency contracts is based on a comparison of the contractual and year end exchange rates. The fair values of other

derivative financial instruments are estimated by discounting the future cash flows to net present values using appropriate market rates prevailing at

the year end.