Experian 2007 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2007 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Experian Annual Report2007 |103

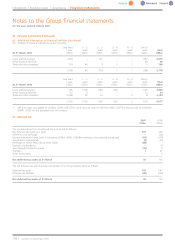

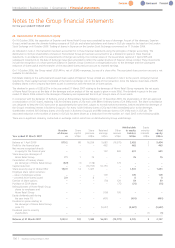

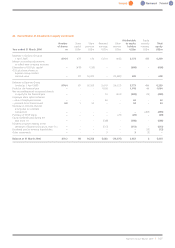

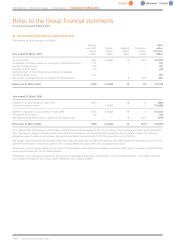

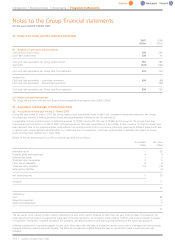

26 Financial instruments (continued)

(c) Additional information on financial liabilities (continued)

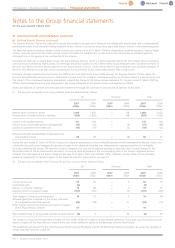

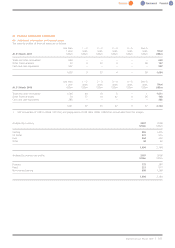

(ii) Analysis of financial liabilities by currency:

Sterling US Dollar Euro Other Total

At 31 March 2007 US$m US$m US$m US$m US$m

Loans and Borrowings

€548m 4.125% Euronotes 2007 – – 751 – 751

£350m 6.375% Eurobonds 2009 721 – – – 721

£334m 5.625% Euronotes 2013 627 – – – 627

Overdrafts 4 – 269 – 273

Effect of forward foreign exchange contracts and cross currency swaps2(1,065) 1,513 (516) 68 –

Other financial liabilities 40–––40

Trade and other payables1207 409 120 30 766

534 1,922 624 98 3,178

Sterling US Dollar Euro Other Total

At 31 March 2006 US$m US$m US$m US$m US$m

Loans and Borrowings

€568m 4.125% Euronotes 2007 – – 688 – 688

£350m 6.375% Eurobonds 2009 620 – – – 620

£350m 5.625% Euronotes 2013 595 – – – 595

Perpetual Securities 386 –––386

Bank loans 696 662 – – 1,358

Overdrafts – – 245 – 245

Effect of cross currency swaps2(947) 755 122 70 –

Other financial liabilities 51 – ––51

Trade and other payables11,552 454 108 20 2,134

2,953 1,871 1,163 90 6,077

1. VAT and other tax payable of US$42m (2006: US$125m), social security costs of US$75m (2006: US$75m) and accruals of US$200m

(2006: US$231m) are excluded from this analysis.

2. These represent the gross notional values of cross currency swaps and foreign exchange contracts if applicable.

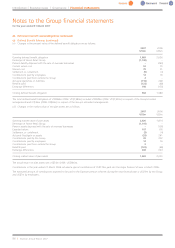

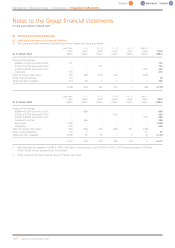

(iii) Analysis of financial liabilities by interest rate profile:

Non-interest

Floating Fixed bearing Total

At 31 March 2007 US$m US$m US$m US$m

Loans and borrowings 1,024 1,348 – 2,372

Effect of interest rate swaps1130 (130) – –

Other 40 – 766 806

1,194 1,218 766 3,178

Non-interest

Floating Fixed bearing Total

At 31 March 2006 US$m US$m US$m US$m

Loans and borrowings 1,603 2,289 – 3,892

Effect of interest rate swaps1825 (825) – –

Other 13 122 2,050 2,185

2,441 1,586 2,050 6,077

1. These represent the gross notional value of interest rate swaps.