Experian 2007 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2007 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Experian Annual Report 2007 |55

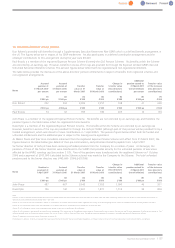

8. GUS Performance Share Plan

In June 2006, executive directors received a share award under the GUS Performance Share Plan (PSP) with a face value of one times salary.

On demerger, these awards were automatically rolled over into Experian shares. As approved by GUS shareholders at the EGM, awards

equivalent to two times salary were made to executive directors on demerger in October 2006. Both awards are outlined below. For awards

granted under the rolled over GUS Performance Share Plan awards the performance condition is based on Total Shareholder Return (TSR)

against the comparator group adopted by Experian (see 2.1c above) since the demerger. Rolled over awards will not vest if Experian’s total

shareholder return (defined as share price movement plus reinvested dividends) is below the median return for the comparator group. For

these rolled over awards only, once Experian achieves median performance, 40 per cent of the award may vest rising on a straight-line basis

to 100 per cent of the award vesting for upper quartile performance or better.

Plan shares

awarded at

1April 2006

Normal

vesting date

Total plan

shares

held at 31

March

2007

Plan shares

awarded

prior to

demerger(1)

Plan

shares

released

prior to

demerger

GUS

share

price on

date of

award

Share

price on

date of

release

Awards

rolled

over into

Experian

shares

Plan

shares

awarded

on

demerger

Experian

share

price on

date of

award

Chairman

John Peace(2)

19.06.03 103,626 – 103,626 675.5p 928.8p – – – June 2006

01.06.04 93,919 – 79,831 809.2p 963.6p – – – June 2007

31.05.05 93,768 – – 858.5p – 166,625 – – May 2008

02.06.06 – 94,492 – 926.0p – 167,912 – – June 2009

334,537

Executive directors

Don Robert

19.06.03 26,619 – 26,619 675.5p 928.8p – – – June 2006

01.06.04 22,481 – 19,108 809.2p 963.6p – – – June 2007

31.05.05 74,334 – – 858.5p – 132,091 – – May 2008

02.06.06 – 74,949 – 926.0p – 133,184 – – June 2009

11.10.06 – – – – – – 246,698 560.0p Oct 2011

511,973

Paul Brooks

19.06.03 16.059 – 16,059 675.5p 928.8p – – – June 2006

01.06.04 16,111 – 13,694 809.2p 963.6p – – – June 2007

31.05.05 16,704 – – 858.5p – 29,683 – – May 2008

02.06.06 – 15,442 – 926.0p – 27,440 – – June 2009

11.10.06 – – – – – – 132,837 560.0p Oct 2011

189,960

Non-executive directors

David Tyler(3)

19.06.03 62,176 – 62,176 675.5p 928.8p – – – June 2006

01.06.04 58,082 – 49,369 809.2p 963.6p – – – June 2007

31.05.05 58,241 – – 858.5p – 103,494 – – May 2008

02.06.06 – 58,855 – 926.0p – 104,585 – – June 2009

208,079

Notes:

1. On demerger,awards made under the 2004 GUS Performance Share Plan were automatically transferred to participants. These awards vested at 85 per cent of the original award. GUS Performance Share Plan awards made in 2005

and 2006 were replaced with an equivalent award over Experian shares.

2. As John Peace’s employment with Experian Finance plc (formerly GUS plc) ended on 31 March 2007, under the rules of the Plan, all outstanding awards will vest subject to the performance condition on the original vesting date

specified in the table, and will be time pro-rated to 31 March 2007. Disclosures will be made in respect of vesting at the appropriate time

3. David Tyler’s awards were rolled over on the basis described in footnote 3 to the Share Options table on page 53.

4. Under the Plan rules, participants are entitled to dividend equivalents on release of awards under the 2004 GUS Performance Share Plan as follows, John Peace £63,864; Don Robert $28,769; Paul Brooks $20,618

and David Tyler £39,496.