Experian 2007 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2007 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

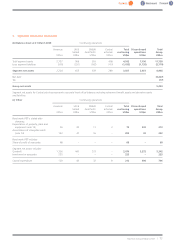

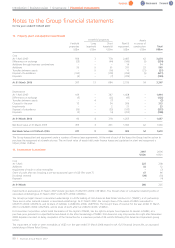

12. Basic and diluted earnings per share

The calculation of basic earnings per share is calculated by dividing the earnings attributable to ordinary shareholders of the Company by a weighted

average number of Ordinary shares in issue during the year (excluding own shares held in Treasury in the period prior to the demerger and own shares

held in ESOP trusts, which are treated as cancelled).

The calculation of diluted earnings per share reflects the potential dilutive effect of employee share incentive schemes. The earnings figures used in

the calculations are unchanged for diluted earnings per share.

The weighted average number of Ordinary shares in issue during the year ended 31 March 2007 includes Ordinary shares of GUS plc in issue to the

date of the demerger and the Ordinary shares of the Company in issue thereafter. The weighted average number of Ordinary shares in issue during

the year ended 31 March 2006 comprises Ordinary shares of GUS plc in issue and reflects the effect of the share consolidation that took place at

the date of the Burberry demerger in December 2005.

2007 2006

Basic earnings per share: cents cents

Continuing and discontinued operations 49.9 107.5

Exclude: discontinued operations (14.8) (59.1)

Continuing operations 35.1 48.4

Add back of exceptional and other non-GAAP measures, net of tax 24.6 6.1

Benchmark earnings per share from continuing operations – non-GAAP measure 59.7 54.5

Diluted earnings per share:

Continuing and discontinued operations 49.3 105.8

Exclude: discontinued operations (14.6) (58.2)

Continuing operations 34.7 47.6

Add back of exceptional and other non-GAAP measures, net of tax 24.4 6.0

Benchmark diluted earnings per sharefrom continuing operations – non-GAAP measure 59.1 53.6

2007 2006

Earnings: US$m US$m

Continuing and discontinued operations 462 1,018

Exclude: discontinued operations (137) (560)

Continuing operations 325 458

Add back of exceptional and other non-GAAP measures, net of tax 229 58

Benchmark earnings – non-GAAP measure 554 516

2007 2006

mm

Weighted average number of Ordinary shares in issue during the year 927.3 946.7

Dilutive effect of share incentive awards 9.9 15.0

Diluted weighted average number of Ordinary shares in issue during the year 937.2 961.7

Experian Annual Report2007 |87