Experian 2007 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2007 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Experian Annual Report 2007 |49

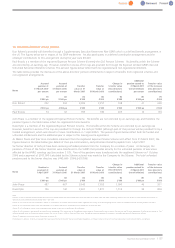

Acxiom Fair Isaac Harte-Hanks

Alliance Data Systems Fidelity National Financial IAC/Interactive Corp

Bisys Group Fimalac Moodys

Capita Group First American Reuters Group

Choicepoint First Data Thomson

Dun & Bradstreet Fiserv Total System Services

Equifax Global Payments

(a) Base salary and benefits

Toascertain the job’s market value, external remuneration consultants annually review and provide data about market salary levels and

advise the Remuneration Committee. Executive directors’ salaries are benchmarked against a mid-market level of main board executive

directors from the comparator companies in the FTSE 100 Index and other global comparators which reflect the market in which we recruit

talent. Before making a final decision on individual salary awards, the Committee assesses each director’s contribution to the business, to

reflect individual performance and experience.

In addition to base salary, executive directors receive certain benefits in kind including a car or car allowance, private health cover and life assurance.

(b) Annual bonus and Co-investment Plan

Annual bonuses are awarded for achieving profit growth targets. We believe that linking incentives to profit growth helps to reinforce our

growth objectives. Targets are calibrated by Kepler using benchmarks that reflect stretching internal and external expectations. Benchmarks

include: broker earnings estimates; earnings estimates for competitors; straight-line profit growth consistent with median/upper quartile

shareholder returns over the next three to five years; latest projections for the current year; budget; strategic plan; long-term financial goals.

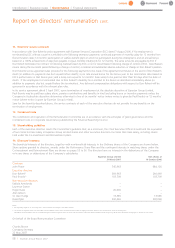

2006/07 bonus

For bonuses paid in respect of the year ended 31 March 2007, executive directors were eligible for an annual incentive with a target of 50

per cent of salary and a maximum of 100 per cent of salary for substantially exceeding targets. Actual bonuses awarded were midway

between target and maximum level. This is reflective of strong performance against targets. The executive directors will be entitled to

participate in the final cycle of the GUS Co-investment Plan as invitations to participate were issued prior to the confirmation of the

demerger. Participants in the GUS Co-investment Plan receive a matching award of shares which rises on a sliding scale up to 2:1 for

maximum performance. The matching awards will vest three years following the date of grant. There will be no further awards under the

GUS Co-investment Plan.

2007/08 bonus

As disclosed in the demerger shareholder circular, it was agreed that for annual bonuses paid in respect of the year ending 31 March 2008, the

maximum bonus opportunity for executive directors would increase to 200 per cent of base salary. This level of annual bonus would only be

paid if Experian’s financial performance surpassed stretching financial targets and hence would only be payable if exceptional results were

delivered to shareholders. The extension to the bonus opportunity for the executive directors was intended to recognise the global market in

which Experian operates and to place a larger proportion of the executive directors’ total remuneration at risk and accompanied the reduction

of the matching opportunity under the Experian Co-investment Plan to 1:1 (previously 2:1 under the GUS Co-investment Plan). Executive

directors will not participate in the Experian Co-investment Plan for the 2007/08 fiscal year and any bonus payment will be made in cash.

2008/09 bonus

For annual bonus earned in respect of the 2008/09 fiscal year, executive directors will be offered their first opportunity since the demerger

to defer receipt of their bonus and invest it in Experian shares (“invested shares”) under the Experian Co-investment Plan. The release of

the invested shares will be deferred for three years. Participants will have dividend and voting rights in respect of the invested shares. The

number of invested shares acquired on behalf of the executive will be matched with an additional award of shares (“matching shares”).

The release of these matching shares to participants will be subject to the achievement of a performance condition.

The release of these shares will be deferred for three years including the original bonus deferral. Dividends will be accrued on these awards.

If an executive resigns during the three-year period he/she will forfeit the right to the matching shares and the associated dividends.

(c) Experian Performance Share Plan

The Experian Performance Share Plan was approved by GUS shareholders at the EGM on 29 August 2006. An initial award was made to

participants, including the executive directors, on 11 October 2006. There will be no further awards to executive directors under this plan

until June 2009. Performance shares are‘free’ Experian shares for which no exercise price is payable. The award is communicated to

participants as an allocation of shares which are subject to a performance condition which is measured over a three-year performance

period with a five-year vesting period. Dividends will accrue on these awards.

For the above demerger awards granted in October 2006, the performance condition is in two separate parts; 50 per cent of the award

will be subject to achievement against a sliding scale of growth in profit before tax (PBT). The threshold for vesting will be growth in PBT of

7per cent per year at which 25 per cent of this partof the awardwill vest rising, on a straight-line basis, to 100 per cent of this partof the

awardvesting at a growth in PBT of 14% per year.

The remaining 50 per cent of the award will vest according to the performance of Experian’s total shareholder return (TSR) relative to the

following group of peer companies: