Experian 2007 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2007 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Introduction | Business review | Governance | Financial statements

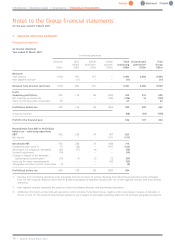

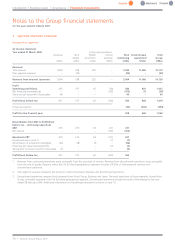

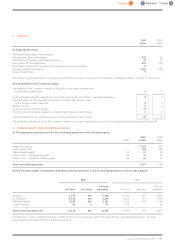

2. Basis of preparation and significant accounting policies (continued).

Share-based payments

The Group has a number of equity settled share-based payment arrangements in existence. The assumptions used in determining the amounts

charged in the Group income statement include judgements in respect of performance conditions and length of service together with future

share prices, dividend and interest yields and exercise patterns.

Critical judgements

Management has made certain judgements in the process of applying the Group’s accounting policies set out above that have a significant effect

on the amounts recognised in the Group financial statements. These include the classification of transactions between the Group income

statement and the Group balance sheet. These accounting policy descriptions indicate where judgement needs exercising.

The most significant of these judgements is in respect of intangible assets where certain costs incurred in the developmental phase of an internal

project are capitalised if a number of criteria are met. Management has made certain judgements and assumptions when assessing whether a

project meets these criteria, and on measuring the costs and the economic life attributed to such projects. On acquisition, specific intangible

assets are identified and recognised separately from goodwill and then amortised over their estimated useful lives. These include such items as

brand names and customer lists, to which value is first attributed at the time of acquisition. The capitalisation of these assets and the related

amortisation charges are based on uncertain judgements about the value and economic life of such items. The economic lives for intangible

assets are estimated at between 3 and 7 years for internal projects, which include databases, internal use software and internally generated

software, and 2 and 10 years for acquisition intangibles.

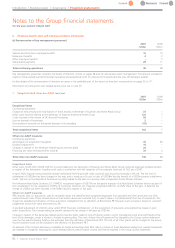

Recent accounting developments

The following accounting standards, amendments and interpretations issued by the IASB and the International Financial Reporting Interpretations

Committee (‘IFRIC’) are effective for the Group’s accounting periods beginning on or after 1 April 2007:

•IFRS 7 ‘Financial Instruments: Disclosures‘ and amendments to IAS 1’Presentation of Financial Statements - Capital Disclosures’;

•IFRS 8 ‘Operating segments’(*);

•IAS 23 ‘Amendment to IAS 23 ‘Borrowing Costs’;

•IFRIC 8 ‘Scope of IFRS 2’;

•IFRIC 9 ‘Re-assessment of embedded derivatives’;

•IFRIC 10 ‘Interim financial reporting and impairment’(*);

•IFRIC 11 ‘IFRS 2 – Group and Treasury Share Transactions’(*);

•IFRIC 12 ‘Service Concession Arrangements’(*).

(*) These standards are still subject to adoption by the EU.

These changes arenot expected to have a material effect on the results and net assets of Experian. A number of the developments will lead to

additional disclosures.

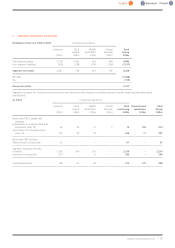

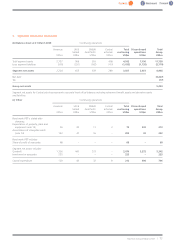

Use of non-GAAP measures

The Group has identified certain measures that it believes will assist understanding of the performance of the business. The measures are not

defined under IFRS and they may not be directly comparable with other companies’ adjusted measures. The non-GAAP measures are not

intended to be a substitute for, or superior to, any IFRS measures of performance but management has included them as they consider them to

be important comparables and key measures used within the business for assessing performance.

The following are the key non-GAAP measures identified by the Group:

Benchmark Profit beforeTax (‘Benchmark PBT’)

Benchmark PBT is defined as profit before amortisation of acquisition intangibles, goodwill impairments, charges in respect of the demerger-

related equity incentive plans, exceptional items, financing fair value remeasurements and taxation. It includes the Group’s share of associates’

pre-tax profit.

Earnings before Interest and Tax (‘EBIT’)

EBIT is defined as profit before amortisation of acquisition intangibles, goodwill impairments, charges in respect of the demerger-related equity

incentive plans, exceptional items, net financing costs and taxation. It includes the Group’s share of associates’ pre-tax profit.

Benchmark Earnings per Share (‘Benchmark EPS’)

Benchmark EPS represents Benchmark PBT less attributable taxation and minority interests divided by the weighted average number of shares in

issue, and is disclosed to indicate the underlying profitability of the Group.

Exceptional items

The separate reporting of non-recurring exceptional items gives an indication of the Group’s underlying performance. Exceptional items are those

arising from the profit or loss on disposal of businesses or closure costs of material business units. All other restructuring costs are charged

against EBIT in the segments in which they areincurred.

Net debt

Net debt is calculated as total debt less cash and cash equivalents. Total debt includes loans and borrowings (and the fair value of derivatives

hedging loans and borrowings), overdrafts and obligations under finance leases. Interest payable on borrowings is excluded from net debt.

Notes to the Group financial statements

for the year ended 31 March 2007

72 |Experian Annual Report2007