Experian 2007 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2007 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Introduction | Business review | Governance | Financial statements

Notes to the Group financial statements

for the year ended 31 March 2007

110 |Experian Annual Report2007

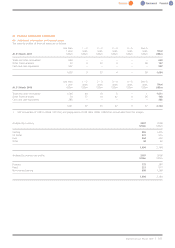

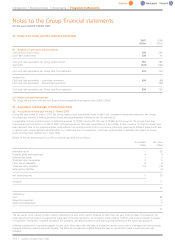

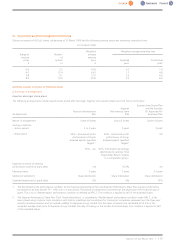

29. Notes to the Group cash flow statement (continued)

2007 2006

US$m US$m

(f) Analysis of cash and cash equivalents

Cash at bank and in hand 798 293

Short-term investments 109 92

Cash and cash equivalents per Group balance sheet 907 385

Overdrafts (273) (246)

Cash and cash equivalents per Group cash flow statement 634 139

Analysed as:

Cash and cash equivalents – continuing operations 634 (89)

Cash and cash equivalents – discontinued operations –228

Cash and cash equivalents per Group cash flow statement 634 139

(g) Major non-cash transactions

The Group did not enter into any new finance lease arrangements during the year (2006: US$nil).

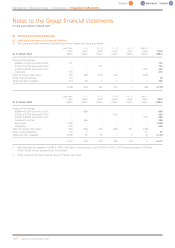

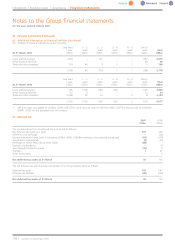

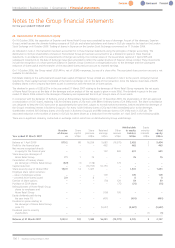

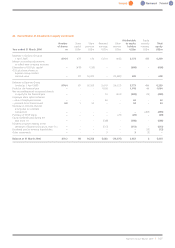

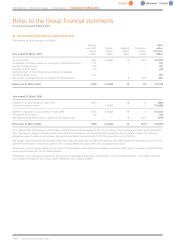

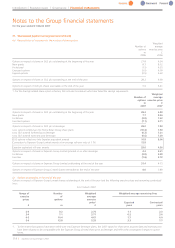

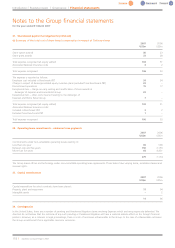

30. Acquisitions and demerger of Home Retail Group

(a) Acquisitions for the year ended 31 March 2007

During the year ended 31 March 2007, the Group made several acquisitions, none of which are considered individually material to the Group,

including Eiger Systems a leading provider of bank validation/payment software in the UK and Ireland.

In aggregate, the acquired businesses contributed revenues of US$20m and profit after tax of US$3m to the Group for the periods from their

respective acquisition dates to 31 March 2007. If these acquisitions had been completed on 1 April 2006, further revenues of US$12m would have

been reported. Due to the acquired entities using different accounting policies prior to acquisition, previously reporting to different period ends and,

in certain cases, preparing financial information on a cash basis prior to acquisition, it has been impracticable to estimate the impact on Group

profit had they been owned from 1 April 2006.

Details of the net assets acquired and the provisional goodwill are as follows:

Book value Fair value

US$m US$m

Intangible assets –20

Property, plant and equipment 44

Deferred tax assets –5

Trade and other receivables 55

Cash, net of overdrafts 88

Trade and other payables (12) (15)

Deferred tax liabilities – (7)

Net assets acquired 520

Goodwill 71

91

Satisfied by:

Cash 80

Acquisition expenses 2

Deferred consideration 9

91

The fair values set out above contain certain provisional amounts which will be finalised no later than one year after the date of acquisition. Fair

value adjustments in respect of acquisitions made during the year resulted in an increase to book value of US$15m and arose principally in respect

of acquisition intangibles. Goodwill represents the synergies, assembled workforce and future growth potential of the businesses acquired.

Deferred consideration is primarily payable in cash up to three years after the date of acquisition and in some cases is contingent on the businesses

acquired achieving revenue and profit targets. The deferred consideration settled during the year on acquisitions made in previous years was

US$44m.